The Benefits of Legal E-Billing Software for Your Law Firm

By Adrian Aguilera

Get paid faster and more efficiently by replacing time-consuming admin and paper processes with legal e-billing software.

With legal e-billing management, you can easily track billable hours, reduce invoicing errors, and speed up payment with automated follow-ups and instant collection. Overall, your firm can receive a boost in productivity, freeing up more time for your client cases. In this article, we’ll cover some of the most common e-billing questions so you can make the most informed decision on a platform that works for your firm.

Common questions include:

- What is e-billing?

- How does e-billing work?

- What are the benefits of legal e-billing solutions?

- How can I quickly implement a legal electronic billing system into my firm?

What is E-Billing?

With an e-billing system, law firms can streamline their billing processes by creating, reviewing, and sending client invoices electronically. This eliminates the time-consuming traditional method of developing, enveloping, and sending invoices via snail mail. An e-billing solution also provides convenience as clients can view and instantly pay their bills with the click of a button.

How Does E-Billing Work?

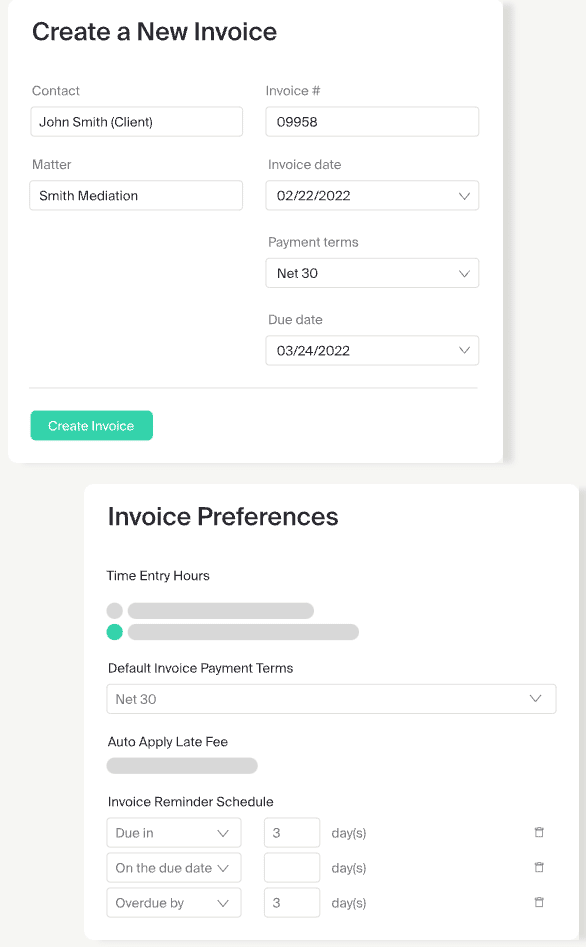

Electronic billing solutions offer tools that help law firms effectively track and manage time and billable work, arrange and send invoices, and stay in sync on billing processes. it For example, with MyCase, each team member can set up to three timers—making it easy to keep track of billable hours and record work descriptions as it happens. And, nothing will slip between the cracks as this function is available on desktops, laptops, and mobile devices.

When it’s time to bill the client, the tracked time and descriptions automatically log into the electronic invoice. If adjustments are needed, you can change or delete any automated item, as well as add additional work and hours.

If needed, you can also integrate the Legal Electronic Data Exchange Standard (LEDES) with Uniform Task-Based Management System (UTBMS) codes, so your invoices match universal standards. Once you’re ready to deliver the invoice to the client, you can send it electronically via email, text message, or client portal through the software platform. You can also apply fully automated payment reminders to your desired time frame, saving you more time.

What is LEDES Format?

LEDES formatting provides law firms with a universal requirements standard for the format and order of items listed on invoices. These standards are inputted using a set of unique UTBMS codes for each invoicing element. In-house counsel in large organizations or big corporate clients—those that need one formatting system for all invoicing—are often seen using this.

This format makes processing and paying e-bills quicker and easier. With legal e-billing software, you can access and integrate LEDES billing and UTBMS codes for clients or organizations that require this format.

What Are the Benefits of Legal E-Billing Solutions?

Improved Law Firm Productivity

Manual invoice generation, time tracking, and delivery are a time suck. Legal e-billing platforms simplify and reduce the time it takes to track billable hours, thanks to automatic timers, descriptions, and invoice automation features.

These systems also improve productivity by allowing you to see all your work per case. So, if you’re spending too much time on a certain case(s), you can set up a calendar meeting through the system and prioritize your team’s caseload for the day.

Decreased Billing Errors and Boosted Cash Flow

Legal e-billing platforms have two huge benefits, which include:

- Reducing invoicing errors

- Increasing payments

This happens as all work is tracked and integrated into a single software service.

With a legal e-billing system, you can eliminate the last-minute scramble of figuring out what you worked on for the day, week, or month and the timing of each task. The software will automatically add all the tracked billable hours from your calls, meetings, litigations, and more when it’s time for client invoicing.

You can also add additional work, hours, and flat fees using invoice customization tools. As a result, your invoices are more precise and accurate, decreasing billing disputes and back-and-forth questions.

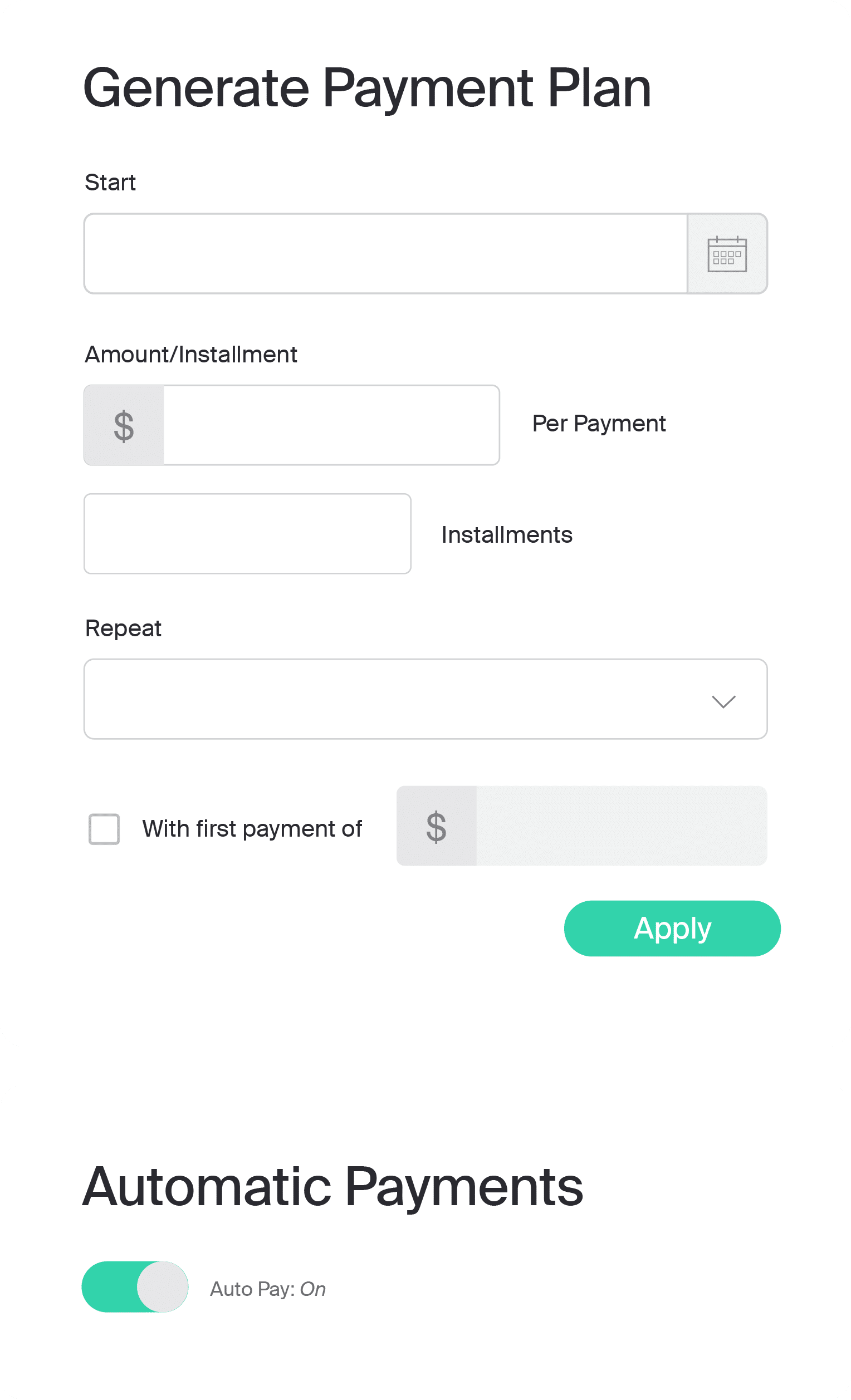

Overall, this instantaneous e-billing system can increase your firm’s cash flow as clients can quickly pay their bills. Furthermore, you can set up payment plans (with automated reminders) for clients who cannot pay in one lump sum. In the long run, you’ll increase your payment collection percentages while delighting your clients with flexible and easy payment options.

Enhanced Transparency and Client Trust

In this era of e-commerce, an e-billing solution is an essential component of the high-quality service that clients expect. With credit, debit, and ACH (eCheck) payment options, clear service descriptions, and installment plans, e-billing allows you to earn greater client trust and value than cash or check invoices.

Your clients only need a desktop/mobile device and an internet connection to pay the bill. This reduces delays both ways, which means happier clients and a healthier payment collection flow. Better invoice transparency also increases the likelihood of five-star reviews.

How Can I Implement E-Billing Software?

Adopt a Cloud-Based Solution

Cloud-based systems specializing in law firm productivity are the best way to implement e-billing for your law firm. These systems are designed specifically for the needs of law firms and are an all-in-one software service. You won’t need to fumble through multiple programs.

Features such as document management, workflow automation, calendaring, time tracking, billing, and invoicing work in unison to provide an all-encompassing user-friendly and accurate platform that is easy for your team to use.

Establish a Concise E-Billing Policy

An e-billing policy is necessary to help your team and clients understand how the e-billing process works for them. This further ensures that the client agrees to the payment process, options, and timelines.

You’ll also need a policy for your team that outlines how the legal electronic billing system will replace current manual processes. You can start by directing your team to attend a Zoom product intro with the e-billing software representative. From there, you can map out and introduce a clearly-written guide. This will help your team when implementing the new e-billing software.

Although e-billing automates the invoicing process, your firm’s e-billing policy should include an internal invoice review system that ensures clear and concise invoices—especially when LEDES formatting is required. Lastly, your policy should outline who will review and follow up on any potential dispute or collection issues. With a clear policy in place, you can easily and smoothly roll out law firm e-billing into your business with a clear policy in place.

Build E-Billing Invoice Templates

E-billing software may come equipped with broad templates; however, you should create custom templates as starting points for each portion of your billing services. This customization is one of the best elements of legal e-billing management that can serve as a base point for every area of your law firm’s work. You can then use time tracking, payment, and reporting tools to create well-structured invoices. For more information, read our guide to legal billing or check out our collection of legal invoice template examples.

Choose the Best E-Billing Software for Your Law Firm

MyCase legal e-billing software provides everything you need to smoothly implement the system into your law firm’s invoicing, payment, and collection process. Stop wasting time with archaic invoicing and adopt a user-friendly legal electronic billing system that can help your firm get paid faster, improve productivity, and increase client trust. Try MyCase today—risk-free with a 10-day free trial.