Legal Billing Software: The Definitive Guide

Administrative tasks like lawyer billing or legal invoicing are critical to the success of any law firm. Unfortunately, these tasks remain some of the most time-consuming, dreaded, and repetitive parts of the job for many law firms.

Law firm billing and invoicing can significantly take up time that could otherwise be spent serving clients. When not done efficiently and correctly, these tasks can affect your bottom line and relationships with clients.

For those reasons, it is essential to streamline processes that:

- Reduce the time taken and the repetitive tasks associated with tracking billable time

- Simplify the legal invoice creation process

- Make it easy to invoice clients

- Standardize the steps and processes you need to receive and account for payments

Before the advent of lawyer billing software, attorneys had to set aside significant time to tasks such as tracking and entering billable time, preparing and sending invoices, pre-bill and revenue recognition, following up on sent invoices, processing payments, or updating trust ledgers. Unfortunately, these administrative tasks take away from the time they allocated for legal work.

What is Law Firm Billing?

Law firms must have a clear, standardized lawyer billing process in place to save valuable time and money. Doing so ensures that all lawyers and staff are on the same page and in sync. Your firm’s process should take into account:

- How your firm bills clients

- Where the most errors occur

- Which stages of the law firm billing process cause the most significant bottlenecks

In many cases, the lawyer billing process will follow this general approach:

- A new client retains the firm and a case is opened

- The lawyer handling the case starts logging billable time and disbursement expenses

- At the end of each month, the firm adds billable time and expenses to a draft bill

- Attorneys add notes or adjust costs as needed before approving the bill

- The firm’s billing coordinator creates a final version and sends a letter and invoice to the client via the post office

- Clients pay using one of the firm’s approved methods, sometimes sending a physical check which, when received, needs to be deposited in the bank

- The accounting team sends updated trust ledgers and follow- up reminders for late payments

The above process seems straightforward but has plenty of room for wasted costs and other bottlenecks. For example, some attorneys might take too long to approve a legal bill, while others may make numerous edits, causing a delay in dispensing bills.

How Lawyers Bill Time and Expenses

Lawyers track their billable time and costs as they incur them, a process that is simplified when law firm records are complete and organized. Luckily, lawyer billing software allows them to accomplish these tasks because it seamlessly integrates the process into the lawyer’s existing workflow.

Billable vs. Non-Billable Time

Attorneys who charge by the hour will invoice clients for the time spent researching, writing motions, reviewing discovery, investigating, meeting the opposing counsel, and in court. In short, billable hours include the time spent working on a client’s case.

On the other hand, non-billable time refers to law firm administrative or business development activities that are not charged to clients since they do not constitute legal work: . Non-billable hours include:

- Time investments such as networking, continuing legal education, and rainmaking

- Timekeeping—hence the need for lawyer billing software to reduce the amount of time spent tracking and entering billable time

- Other administrative functions and errands

Lately, many lawyers are moving away from using hourly billing to charge for legal services because it does not apply to every practice area and situation. Instead, pursuing several different types of alternative billing arrangements and payment plans.

Time Increments or Task-Based Billing

When it comes to time increments billing, law firms often choose between one of the following standard increments:

- 1/10th of an hour (six minutes)

- 1/6th of an hour (ten minutes)

The lawyer documents the time spent providing legal services in either tenth, sixth, or quarters of an hour. To calculate compensation, they multiply the total hours spent working by the applicable billing rate per hour. Then, they calculate each service category’s total separately and enter the category and all grand totals on the corresponding lines on the voucher form.

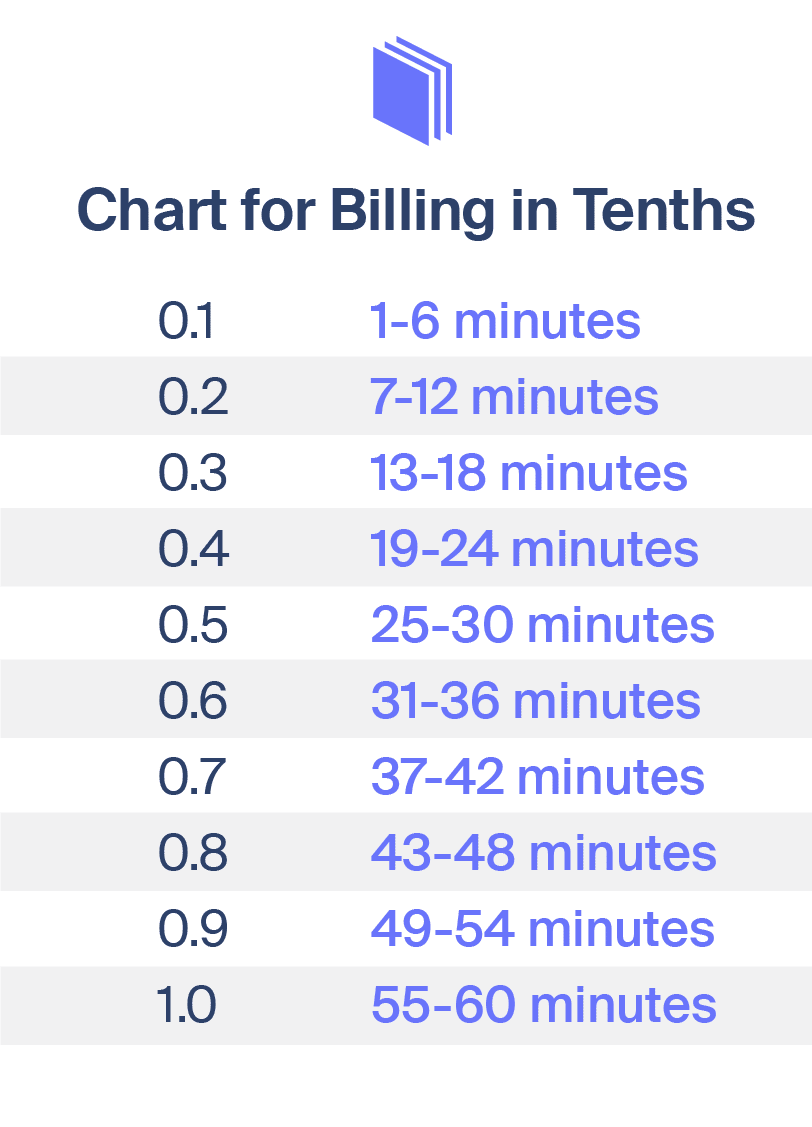

For example, if you used the 1/10th of an hour increments chart and worked for 40 minutes at the rate of $120 per hour, you will multiply $120 by the corresponding time increment of 0.7 from the chart below to get $84.

Billing in six minutes increments is a standard practice because it is much simpler than billing by the minute or by other smaller increments. Additionally it makes it possible to bill in reasonable increments, and reduces the need to regularly round up or excessively pad invoices. Traditional legal billing increments are products of convenience. Lawyers decide which increments to use and then round up to the nearest billing increment they choose. Learn more about the benefits of a legal billable hours chart by reading this article.

Alternative Lawyer Billing Arrangements

Some lawyers opt for one of the following alternative legal bill arrangements:

Flat Fees: These are best for more cut-and-dry matters such as a simple bankruptcy or preparing a living will. However, you should lay out the fee at the start of the legal relationship, so the client understands what the fee covers. For example, filing fees may not fall under a flat fee in some instances.

Contingency Fee: Here, the attorney takes a certain percentage of the client’s monetary damages or settlements from the case. Typically, contingency fees are standard in civil suits such as personal injury or medical malpractice litigation.

Retainer: Typically, retainers are collected by attorneys at the start of a case. You can then bill off of the retainer as legal work is performed. When the retainer is nearly depleted you can then invoice your client and replenish the retainer account.

Unbundled fees: These apply to limited scope representation. The attorney and client agree to define the extent of the lawyers’ involvement in the client’s case. Unbundled legal services vary greatly, depending on the agreed-upon tasks. For example, unbundled legal services can include suggesting court documents that clients should prepare or providing limited litigation or guidance.

Sliding Scale Fees: These apply to attorneys who work with low-income clients. Attorneys charge legal fees based on household income and forgo a standard rate. This approach gives law firms access to more clients.

Subscription-Based Fees: Subscription-based law firms provide legal services to clients on an as-needed basis and charge a set monthly subscription fee. The arrangement favors small business clients who require regular help with things like business transactions, trademark applications, or proactive IP protection measures.

Reimbursable Expenses vs. Overhead

Reimbursable costs are also known as advanced client costs. Typically, law firms incur different types of expenses on behalf of clients, which are reimbursable during client billing. These costs fall under one of two expenses as follows:

Direct litigation expenses (hard costs): These include court filing fees, mediation fees, deposition fees, expert witness fees, court reporting fees, hearing transcript fees, and medical record expenses.

Overhead expenses (soft costs): These are support-type services. While many law firms consider these overhead expenses, some choose to pass the costs over to the client. They include faxing costs, postage fees, clerical services, online research, app costs, legal research costs, and delivery services.

What is Legal Billing Software?

Lawyer billing software enables law firms and lawyers to collect payment from clients for their time, effort, and expertise. Robust legal billing systems are optimized for the legal profession and feature time tracking, invoicing, accounting, payment, and reporting capabilities. In addition, legal billing software can and is often integrated into case management systems to give law firms a holistic picture of the firm’s financial health.

Legal billing systems also provide law firms the information needed to reconcile debts, offer promotions and bonuses to associates where applicable, and help monitor firm financial activities through reporting capabilities.

These days, legal e-billing software is very prevalent among many legal practices nationwide because it helps lawyers and their firms save time that is otherwise spent on cumbersome administrative tasks. Firms that benefit from legal billing software have the following common problems:

- Billing takes up a lot of time

- They suffer from a backlog of outstanding bills

Investing in legal billing software mitigates a firm’s risk of error and makes its processes run more smoothly.

Essential Features to Look for in Legal Billing Systems

When thinking about investing in legal billing software, it is crucial to consider your processes before technology. Find a law firm billing system that integrates well with your other processes and programs. For example, ideally your firm’s billing system should integrate with your preferred accounting programs such as Xero and QuickBooks Online.

Additionally, don’t let a perceived learning curve prevent your firm from transitioning to a new legal billing system; if the software is intuitive and fits nicely into your firm, implementation likely won’t be as difficult as you might expect. An investment in billing software that is a good fit for your law firm, will pay off in the long run and result in a lifetime of simplified billing practices.

Below are five primary features to look for the best legal billing software for your law firm:

Legal Invoicing

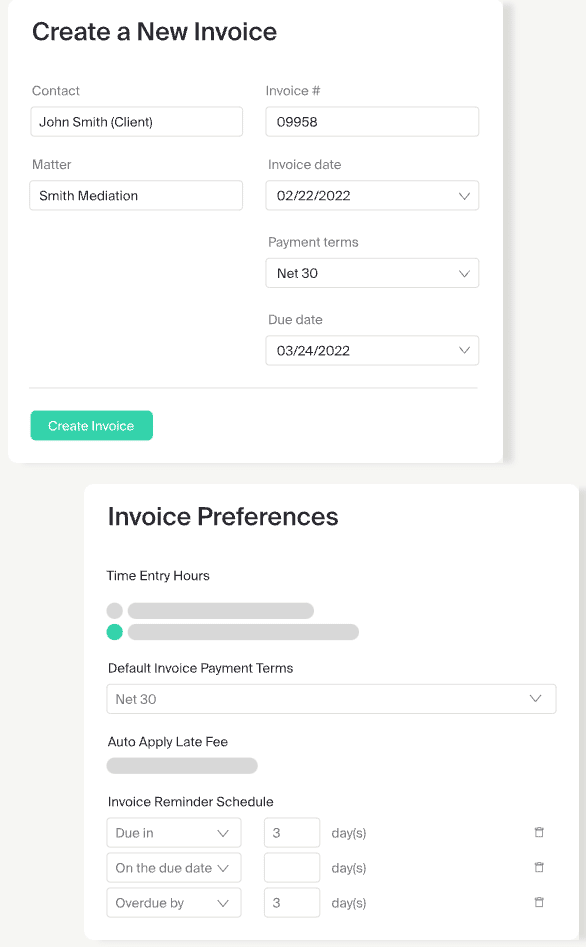

Flexible legal invoices are at the core of lawyer billing software. Your law firm needs adequate flexibility when generating legal invoices. One example is the ability to make a customized invoice with your firm’s logo on it. Also helpful are more advanced features such as automatic interest or tax calculation.

It is also important to ensure the software supports your firm’s billing system, such as LEDES billing task codes.

Additionally, check that the lawyer billing software supports other less obvious features, for example, editing legal invoices after the fact. These additional features show that the software provider understands how law firms invoice their clients and has anticipated your firm’s needs.

For more on invoicing, read our legal billing guide.

Time and Expense Tracking

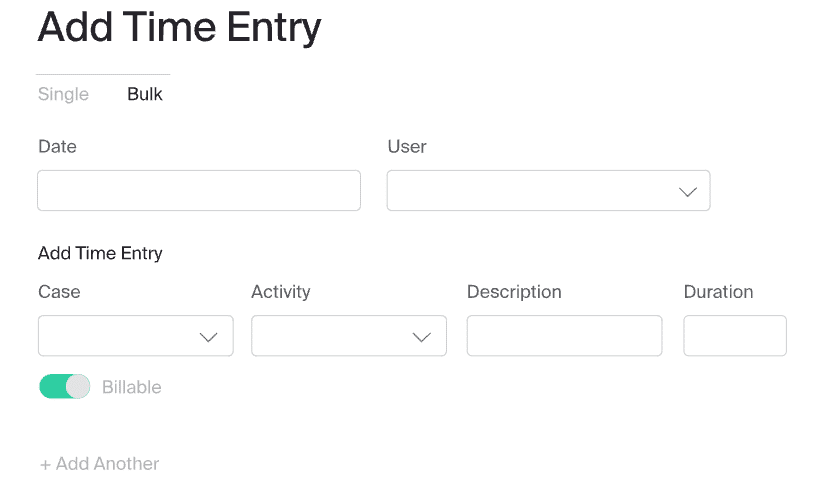

Efficient and straightforward time tracking is also at the core of any law firm software. Therefore, when investing in attorney billing software, it is essential to consider time and expense tracking capabilities.

Ideally, this tracking functionality should be compatible with all types of lawyer billing arrangements (e.g. hourly, flat fee, contingency) so law practices can use it regardless of the billing approach taken for any given case.

In addition, it should track time even without access to the internet, which makes traveling and working remotely possible.

What’s more, the time tracking feature should work seamlessly with multiple devices, such as Android phones, iPhone, iPad, Mac, and PC. This allows you to enter hours flexibly and efficiently, while working from anywhere, at any time.

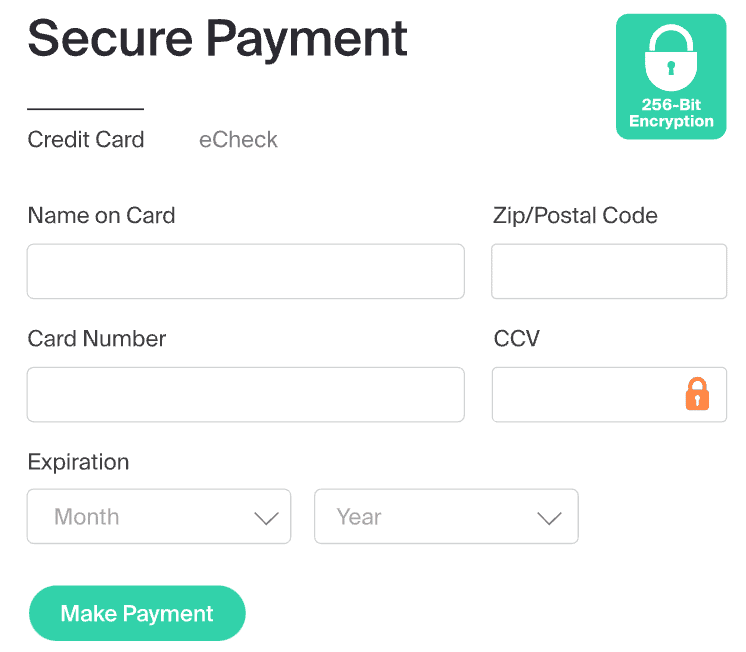

Payment Collection

Payments and cash flows keep the business alive. Therefore, it is crucial to track account receivables and payables, analyze them frequently, and make necessary amendments. The billing software attorneys rely on should also apply discounts, fees, and write-offs and account for payment adjustments and bad debts.

In addition, MyCase allows law firms to automate their account receivables using ethically-compliant law firm billing practices when accepting online payments, like credit, debit, and eCheck/ACH. For example, when clients pay via MyCase Payments, any fees are withdrawn from their operating account rather than a trust account, and their payment is immediately reconciled.. This means firms don’t have to go through the hassle of receiving an electronic payment, and then manually recording the payment in a separate law practice management system. Instead, it’s completely automated, reducing the effort required to keep accounts up to date.

Financial Reporting

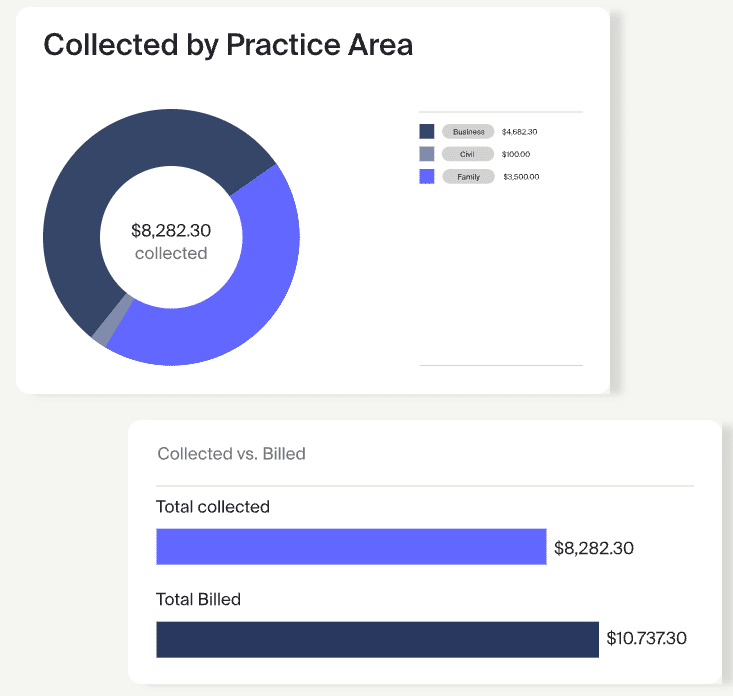

Your lawyer billing software of choice should produce detailed and understandable financial reports. Then, after everyone in your law firm enters their billed time, sends clients invoices, and collects payments, you should be able to understand the big picture through a report.

The ability to create detailed and easy-to-understand financial reports allows everyone in the law firm to quickly analyze all financial data, including billable hours, the productivity of lawyers, and revenues and commissions. For instance, rather than receiving a complicated spreadsheet with calculations, your attorney billing software should provide an effective way to calculate attorney compensation using the data entered into the system.

Detailed reports with filters for projects, time, clients, and more allows law firms to understand their businesses and forecast their growth. For example, MyCase offers financial reports, including accounts receivables, time and expense, financial performance, trust account, and case revenue.

For more information on law firm financial metric management, check out this article on how you can analyze the growth of your firm.

QuickBooks Integration

Since most law firms use QuickBooks to manage their accounting and payroll, your chosen billing software should integrate with your chosen accounting software.

Suppose your law firm billing software does not integrate with QuickBooks or any other accounting software your law firm uses. In that case, you will have to manually enter all expenses manually in two different applications and then ensure your records are constantly updated in both, which is time and labor-intensive.

However, if your billing system integrates with your accounting software, when you enter monies received for legal fees in QuickBooks it will automatically appear in your legal billing software as well.

Legal Billing Software Considerations by Firm Size

The type of legal billing software law firms and lawyers select depends on several factors, including the type of buyer. Solo practitioners have different billing software needs than large and corporate firms. Therefore, when you have various legal billing software available, you should also consider your firm’s size and budget.

Solo and Small Law Firms

Solo and small firms must decide whether to buy a stand-alone legal billing solution or invest in a practice management system. Some factors to consider while making this decision include special accounting needs, mobile or remote access, and payment requirements. If the current system is unsuitable, upgrading to a more robust solution can accommodate the lawyer billing demands of busy law firms.

For more on general boutique firm management, read our guide on how to manage a small law firm.

Large and Corporate Law Firms

Large legal firms require extensive functionality to manage individual time-keepers and clients. They also need reporting features to identify revenue opportunities and all the essential features discussed above, namely:

- Legal invoicing

- Time and expense tracking

- Collecting payments

- QuickBooks integration

- Financial reporting

Trends Related to Legal Billing Software

There are a few trends presently dominating the legal billing industry. These include:

Mobile Time Tracking

Mobile has become a critical emerging trend in virtually every industry worldwide, and the legal profession is no exception. Currently, many legal billing solutions offer mobile access to devices such as PCs, tablets, Android phones, and iPhones. Some, like MyCase, even include a mobile app for lawyers to support the increased demand for flexibility with tracking legal tasks from anywhere at any time.

Automated Time Tracking

Given the legal profession’s demanding nature, many attorneys create unaccounted time gaps if they forget to log a time entry. To ensure attorneys capture as many billable hours as possible, some robust legal billing applications now offer a feature that allows lawyers to capture unbilled activities. For instance, the software will search email and calendar apps and find meetings or client emails that are unaccounted for. The MyCase Smart Time Finder captures and summarizes these actions for your review and makes it simple to add a time entry to capture more billable work, preventing commonly forgotten time entries from slipping through the cracks.

All-In-One Applications

Software vendors are moving from single-purpose applications to offering all-in-one solutions. Previous software options would only track billable hours and create invoices, but new more comprehensive solutions such as MyCase provides comprehensive legal suites to manage most firm processes, including legal billing functionality.

Get Started With The Best Legal Billing Software

MyCase legal billing software offers law firms a complete case management solution and provides the tools needed to improve cash flow, firm organization, and productivity. This includes:

Features include:

- Document management

- Workflow automation

- Time tracking

- Billing and invoicing

- Client communication

- And more

Try MyCase today risk-free with a 10-day free trial. We offer affordable monthly and yearly subscriptions. Plus, no commitment or credit card is required, and you can cancel anytime.

Frequently Asked Questions

How do lawyers track their time and expenses?

Lawyers track their billable time and expenses as they incur them. Luckily, legal billing software has made this process much more efficient because it seamlessly integrates into a lawyer’s existing workflow.

What are billable hours for a lawyer?

Billable hours include the time a lawyer spends working on a client’s case or thinking about it. For example, attorneys who charge by the hour will bill clients for hours spent researching, writing motions, reviewing discovery, investigating, meeting with opposing counsel, and appearing in court.

How do lawyers bill their time?

Lawyers may bill their time in different ways, depending on type of practice and the agreement in place with their clients. Hourly billing plus expenses is a very traditional approach. Common alternative methods include retainers, flat fees, and contingency fees.

With hourly billing, lawyers report the time spent offering legal services in either tenth, sixth, or quarters of an hour. To calculate compensation, they multiply the total hours spent working by the applicable billing rate per hour. Then, they calculate each service category’s total separately and enter the category and all grand totals.

How do lawyers get paid?

Lawyers get paid for their services based on specific situations and arrangements (e.g. contingency fee) or the type of practice area (criminal defense, personal injury, entertainment, social security disability, or patent and copyright).

For example, criminal defense attorneys use hourly fee and retainer agreements, personal injury and SSD lawyers rely on contingency fees. At the same time, those with determined legal services like drafting wills and trusts or filing patents charge flat fees.

What should I look for in legal billing software?

When thinking about investing in legal billing software, it is crucial to consider your processes before technology. Additionally, consider the following essential features: time and expense tracking, legal invoice, collecting payments, financial reporting, and QuickBooks integration for accounting.

What auditing safeguards does MyCase have in place to prevent accidental attorney double billing or other accounting errors?

To avoid double billing, law firms should split the bill among the respective clients. Therefore, if you attend a one-hour meeting that applies to four clients, bill each for only 15 minutes (.25). Double billing, or overbilling in any form, is unethical and goes against the American Bar Association’s Rules of Professional Conduct.

Which software programs is MyCase legal billing software compatible with?

MyCase integrates with QuickBooks Online, Microsoft Outlook, Dropbox Business, Google Workspace, Google Calendar, Mailchimp, CalendarRules, and Smith.ai.

How do discounts or write-offs work with MyCase legal billing software?

MyCase allows you to mark write-offs as non-billable to show you will not charge for those items. You can also add a comment explaining why. MyCase enables you to apply a discount by selecting “discount” located on the adjustment section.

Can I apply a late fee to a law firm invoice?

Yes, you can charge a fee or interest on unpaid invoices provided you stay within the law, and your original contract allows it. While late fees are standard practice, you should inform your client of the intention in advance.