Key takeaways

Legal billing consists of selecting a fee structure for each client, tracking expenses, sending bills, receiving payments, and reviewing legal billing reports.

There’s more to making money than simply earning it. After all, it doesn’t matter how many hours you work if you can’t properly track and bill for them. That’s why streamlined, effective legal billing systems are essential for law firms.

If systems run smoothly, legal billing can be a painless—and fruitful—endeavor. But if your firm is relying on clunky, antiquated software and paper systems to send invoices and collect overdue legal bills, it can be a time-consuming waste of resources.

But efficient legal billing isn’t always as easy as it seems. We’ll go over the basics of legal billing and walk through 11 steps to make the process as straightforward as possible.

What Is Legal Billing and How Does It Work?

Legal billing is the process of tracking client-related expenses, invoicing clients, and collecting bills.

Ideally, legal billing follows this process:

The law firm reviews billing terms with the client and adjusts as needed.

The law firm tracks time and expenses.

The law firm collects client-related expense information and adjustments to create an invoice.

The law firm sends the invoice at agreed upon intervals and logs it accordingly.

The law firm receives the payment from clients on time.

The law firm logs the payment accordingly.

It’s much simpler said than done, as outdated software and manual processes can make this a time-consuming endeavor.

Below, we’ll go over ways to modernize your law firm’s legal billing process.

1. Decide Your Rates and How To Bill Clients

One of the most difficult tasks for law firm owners is establishing fees. The needs of larger law practices differ greatly from those of smaller law practices. External factors like the state of the economy and the average prices for local law firms can also significantly affect what people are willing to pay for legal services.

All law firms must abide by the American Bar Association’s (ABA) rules for reasonable fees. Reasonableness is determined by:

Required time, labor, and skills

Capabilities, reputation, and experience of the lawyer(s) delivering the service

Uniqueness and complexity of the questions involved

The likelihood that accepting a case will prevent the lawyer from taking on other work

Average rates for similar legal services in the area

Time limitations mandated by the client or circumstances of the case

Nature and length of professional relationship with the client

Amount of money involved

Whether the fee is fixed or contingent

Results

Consider reviewing these useful touchstones to define your law firm’s rates.

Research Other Law Firm’s Rates

The most traditional method for getting a baseline legal fee set is to ask around. Start by asking trusted colleagues about their typical rates for common services and activities. You can also check online sources, but reliable information may be sparse.

For example, it’s uncommon for law firms to post rates directly on their site. Official sources like the U.S. Bureau of Labor Statistics can give you averages for your area, but it’s not as helpful for understanding nuanced cost breakdowns for specific practice areas or services.

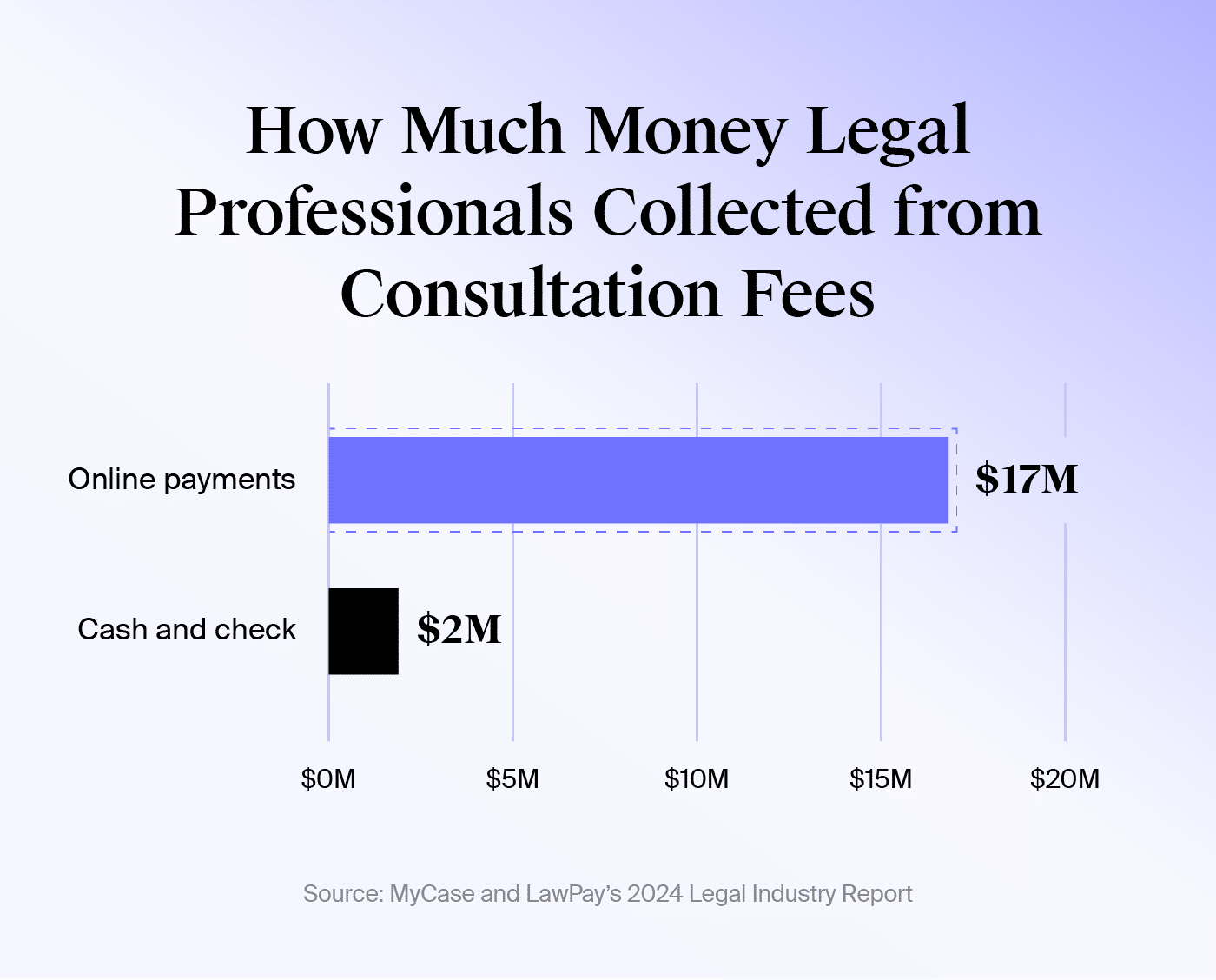

It also pays to align with legal billing trends. Our 2024 Legal Industry report found that 51% of law firms charge for consultations. This additional fee can help increase your law firm’s revenue, especially if you accept online payments. Our customers who charged for consultations collected nearly $17 million from online payments compared to $2 million collected by cash and check.

Determine Your Firm’s Needs

Light research helps you understand your market, but you also need to consider the costs of running your law firm. To get an idea, consider these three elements:

Determine your law firm’s budget requirements and cash flow. Make sure you can make enough money to remain within budget.

Next, decide on a number for a livable annual wage for your law firm.

Lastly, set up financial benchmarks and try to make more money than you need.

Once you’ve got those figures in place, run the numbers back.

To illustrate this simply, let’s say you need to meet a $100,000 budget, need to make $200,000 to acquire a living wage, but want to earn $300,000 a year.

You’re an estate planning attorney thinking of charging $5,000 per estate plan. That means you need to complete, bill, and collect on 20 estate plans in a year to meet your budget, 40 to make a living wage, and 60 to hit your revenue goal.

Tweak the numbers to get to a comfortable workload for yourself.

This is one of the best ways to set rates. Most lawyers focus completely on clients when establishing fees, but this analysis forces you to consider your own interests and the realities of your business plan.

To go further, you can also consider the rule of thirds billing, which deems that a third of revenue should compensate those completing the work, a third covers operating expenses, and a third goes to profit. Determining these numbers requires you to calculate how much your team will need to work to earn their wage.

Know When To Tailor Rates

The most challenging part is knowing when to iterate on your fees. It’s no good setting rates if you regularly deviate from them to accommodate clients or ease anxiety around securing enough business.

To leave room for flexibility, create a fee schedule for your law firm that includes a built-in discount structure that still aligns with your financial goals.

But, also recognize that your law firm rates are not set in stone. You will need to adjust for consumer trends, inflation, client service costs, and other circumstances that require higher or lower rates. Schedule a review of your fees annually to ensure rates are still competitive.

2. Determine Billing and Fee Structure

Another crucial aspect is determining your law firm’s fee model. The most common fee structures include the following:

Hourly rates: Fees charged for each hour of work completed

Capped fees: A version of hourly rates that limit the total amount of time and charges

Flat fees: An all-encompassing cost for a service

Contingency fees: Typically taken from a percentage of funds received after winning a case or settling outside of court.

Evergreen retainers: Funds paid in advance that a lawyer bills against after completing services.

Unbundled services (also called limited scope or à la carte): Limit work to specific tasks rather than helping a client through their entire case

Sliding fees: Based on the client’s income and household size

Sharing additional options beyond billable hours can help your law firm appeal to more clients. For example, some clients may not be able to pay an evergreen retainer upfront or may not trust you enough to invest a large sum. Charging a contingency fee may be more financially feasible for clients, while unbundled services can give clients a “preview” of your work. Additional billing options also make your services more accessible to low-income clients.

3. Set Up Multiple Payment Options

Setting up multiple payment options can help your firm get paid faster. Rather than relying on traditional mail or in-office visits, let your clients choose what works best. For example, our 2024 Legal Industry Report found that 19% of legal professionals collected an additional $10,000 each month when accepting online payments, while another 10% collected between $8,001 and $10,000 more each month.

Below are common payment methods your law firm should offer:

Debit and credit cards

eChecks

Online ACH payments through third-party payment processors

Payments via point-of-sale (POS) systems

Offering additional payment options can also help further tailor choices for your clients. This can include the following:

Legal fee financing: Allow clients to opt into a financing plan with a third party. You’ll receive payment upfront, and the client will work out an agreement with the loan processor.

Split billing: Divide costs among all responsible parties to simplify billing. This is especially helpful for complex cases that involve multiple clients or responsible parties.

Payment plans: Allow clients to pay fees over a long period of time in more feasible increments.

Few things are worse for lawyers than chasing down clients and dealing with payment issues. Luckily, using MyCase’s integration with LawPay’s legal payment solution allows you to bill your clients in whatever way works best for them.

Some features include:

Allowing clients to pay via email, text, point of sale systems, LawPay’s mobile app, and online invoicing

Offering legal fee financing and scheduled payments for more flexibility

Setting a payment plan when creating an invoice, determining what amount is to be paid at what intervals, and automatically calculating installment payments over the appropriate number of invoices

Accessing the Legal Payments Network to get paid faster, accept more secure payment methods, and experience easier reconciliation at no extra charge

Securely storing credit card information through LawPay’s Card Vault

Giving clients the option to view invoices, documents, messages, and payments from within a secure client portal

Creating universal payment links and QR codes to help clients quickly access payment pages

Once payments come through, they’re automatically linked with the corresponding case and client file. This is part of a continuous feed of all financial transactions with that client that helps eliminate guesswork related to reconciliation. This also includes one-off payments for retainers and others that may fall outside of the formal invoicing process.

In addition, you can then set up invoice and installment payment reminders for the amounts due. That way, your client has all the information needed to make regular payments and receive convenient reminders when payments are due.

Learn about the ethical implications of accepting online payments and ways to ensure compliance when using this payment method.

Webinar

Watch Now

4. Streamline Time and Expense Tracking

Time tracking is essential since most law firms offer legal billing rates on an hourly basis. But, even if you’re offering alternative fee agreements, it’s still important to understand how time impacts your firm’s costs and value.

However, time is not the only thing you should be tracking. Understanding expenses and your law firm’s overhead is the starting point for determining law firm pricing and revenue.

This also includes tracking expenses that you can charge back to your client. Not receiving repayment from clients is another surefire tactic for bleeding money.

Follow the steps below to simplify time and expense tracking for your team and ensure you’re getting paid what’s earned and owed.

Tracking billable hours is only half the equation. To ensure you are capturing every recoverable cost from court fees to travel read our practical guide to business expense management.

Centralize Data

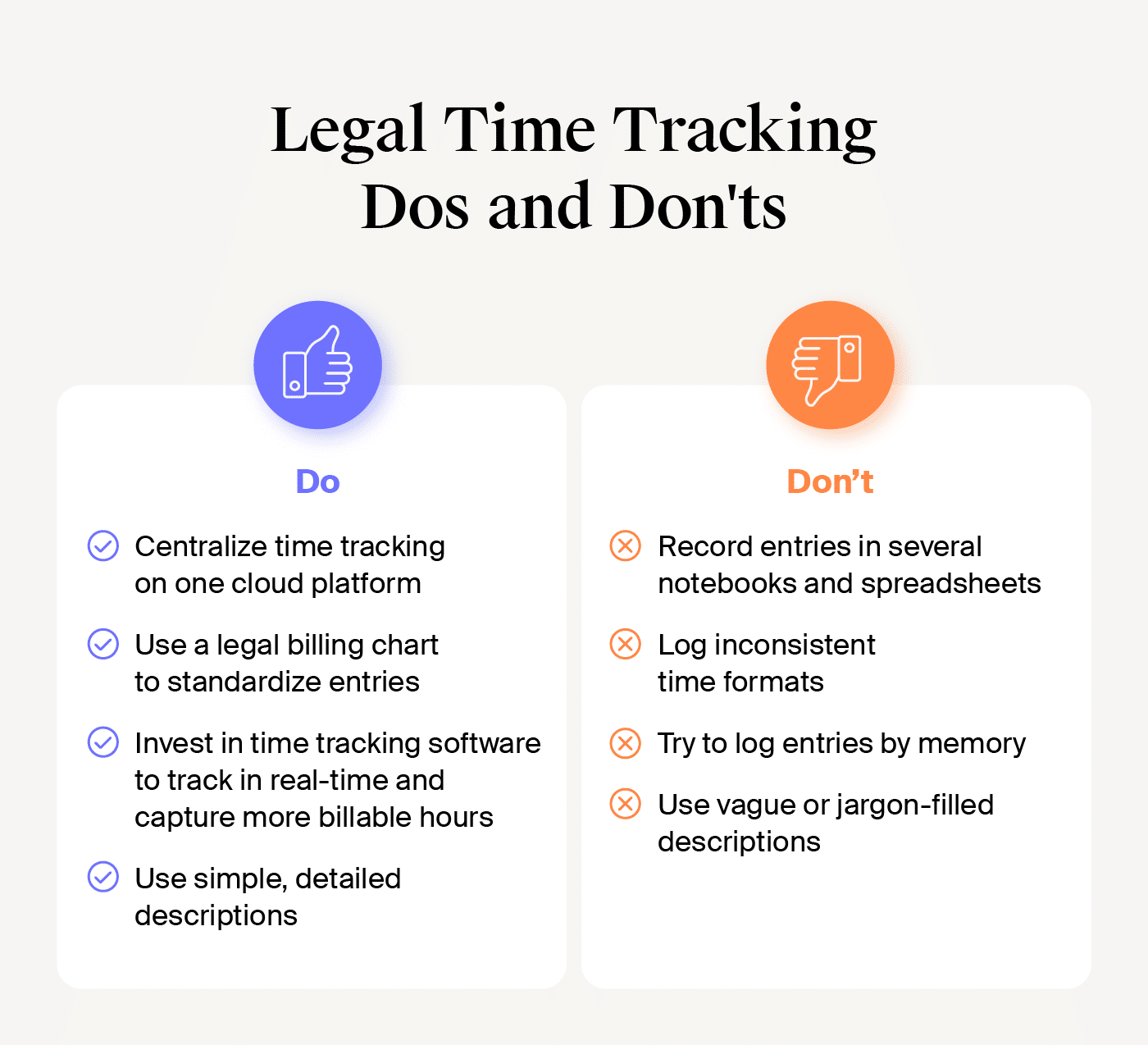

Rather than tracking expenses across different notebooks and spreadsheets, log information in one attorney time tracking template or a single time and expenses tracking solution. By doing so, you can more easily review entries and create invoices.

In addition, many law firms track in billing increments (like billing .1 time for each six-minute increment) and use a legal billing chart to simplify time tracking and billing across their law firm. Establish time tracking guidelines to ensure uniform tracking.

Enforce Real-time Time Tracking

Logging time as work occurs is also important since it’s more efficient than trying to remember what you did weeks later. Passive time tracking tools simplify this even further by tracking time as you work. You can continue your day uninterrupted while your tool automatically records your time.

For example, we learned in our 2024 Legal Industry Report that 50% of law firms who use passive time tracking software capture 1-5 more hours each week. Passive time tracking software tracks time in the background, whereas traditional software requires manual entries.

Furthermore, some tools create a log that can generate client-specific information which you can then edit and add to. For example, MyCase’s platform can see when you send an email and link the activity to an existing client’s contact.

Invest in Automation

Another way to increase law firm billing and time tracking efficiency is to simplify the steps needed to convert billable activities into billable time on an invoice.

Legal time management software can accomplish this goal in any number of ways. Examples of automation include:

Workflows to easily convert events or tasks into billable time

Built-in timers to track in real-time

The ability to automatically reuse billing activity descriptions to avoid manually re-entering descriptions for routine tasks

The easier it is for your attorneys to create a time entry, the more likely they are to capture it as it happens.

MyCase’s time tracking software helps your law firm avoid losing track of time by using built-in timers, surfacing all billable activities for easy time tracking, and enabling your law firm to manage time and expenses in one spot.

Since it’s unlikely that you’ll devote an entire day to one task, you have the option to run up to three timers at once. Just start the timer when you begin working and stop it when you’re done—the software will take care of the rest.

These timers come complete with a standard list of activities, including research, document preparation, or phone calls, and can readily incorporate your hourly rate or any other payment structure you’d like to use for the matter at hand.

MyCase also has timers that automatically run in the background—proactively logging time that you may have missed otherwise. This works in tandem with MyCase’s Smart Time Finder, which records time in the background for a number of routine tasks, spanning phone calls, emails, and text messages. At the end of the month, you can reconcile all your time from your Smart Time Finder to determine what you want to bill.

Our 2024 Legal Trends Report discovered that our customers captured an additional 579,665 hours using Smart Time Finder. Assuming a $330 hourly billable rate, this adds up to $22,425 in billable work per lawyer.

5. Simplify Your Invoicing Process with Software

Before the advent of electronic billing, creating and sending out paper invoices used to be time-consuming. Fortunately, legal billing software has changed that by making it easier to generate legal invoices quickly and by providing the ability to immediately send them to clients electronically.

There are a host of ways to reduce legal billing inefficiencies, but one of the easiest is to limit the number of steps needed to create and send out invoices and trust account requests.

Assemble the Right Information

One way that legal billing software accomplishes this goal is by automatically providing necessary billing information. This includes auto-filling existing billing descriptions for routine tasks, syncing time-tracking data with invoices, and using billing codes to streamline entry tracking.

Additionally, the built-in ability to customize invoices allows you to easily decide what information appears on your firm’s invoices.

For example, MyCase’s Split Billing feature allows you to automatically divide invoices by percentage among multiple parties. Automating this process helps reduce errors and makes each client’s responsibilities clear.

Create Straightforward Invoices

Prospects and law firm clients both have the notion that legal billing rates are too high. As a lawyer, it’s your job to present clear value for the services you provide. The presentation and organization of your invoice can impact how quickly you’ll get paid and minimize the likelihood of disputes. Every time you send a bill, you’re re-convincing the client of the value you told them you would provide when you signed them on.

To that end, the invoices your law firm produces must be professional, compelling, and consistent:

Invoices should share a consistent look and feel. Use the same logo, color scheme, and styling for each statement.

Make billing information easy to read. Avoid using jargon and ensure activities, descriptions, and costs are straightforward to understand.

Ensure your law firm billing process starts and ends as a sales proposition. Provide enough clear explanation to cement the value proposition for each line item. You can also demonstrate value by indicating where you have done work for the client but have not charged them.

Following a consistent and simple process can also make invoice review straightforward. Rather than spending time correcting styling errors or following up on unclear descriptions, you can focus on ensuring entries are correct and match what’s logged in your billing system.

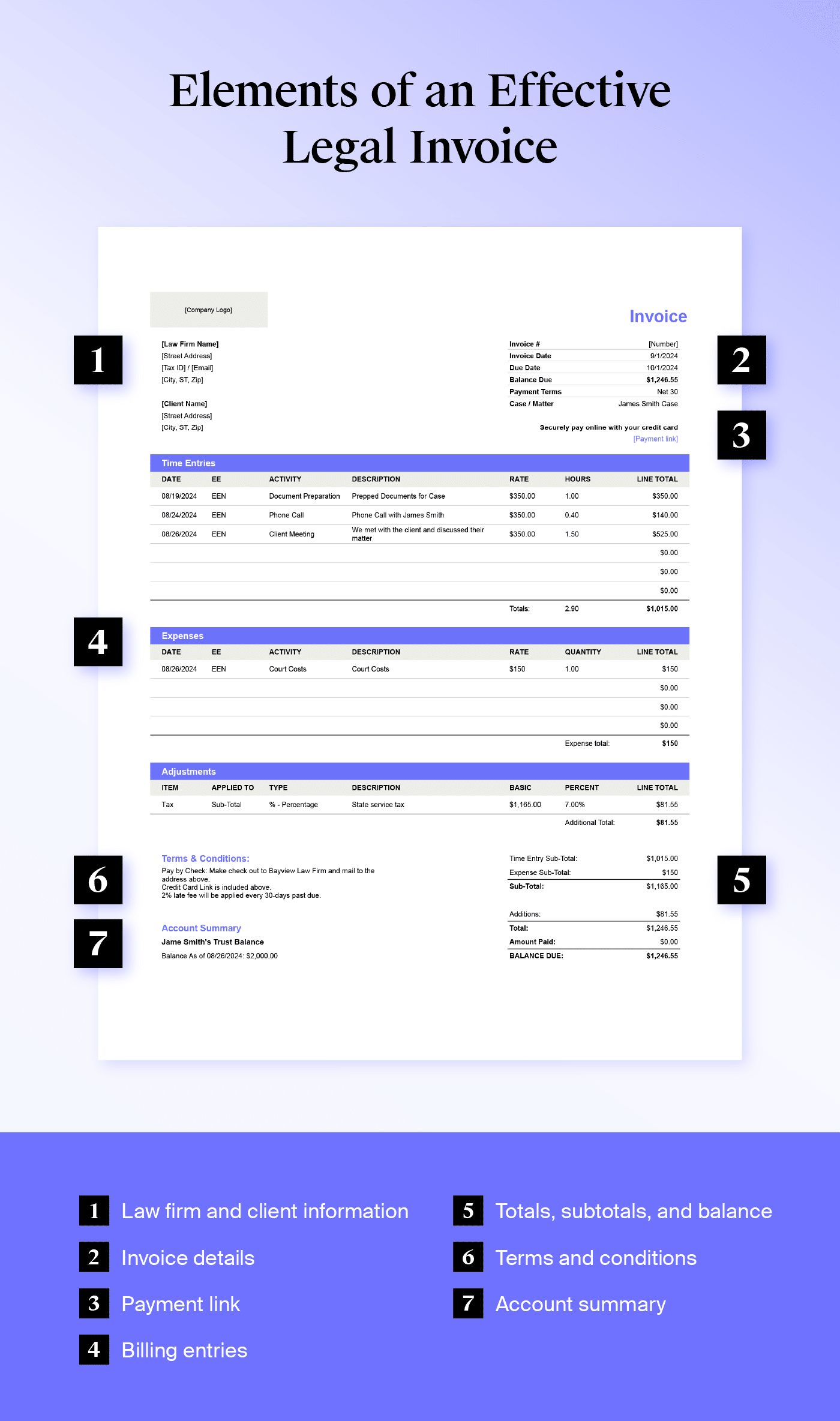

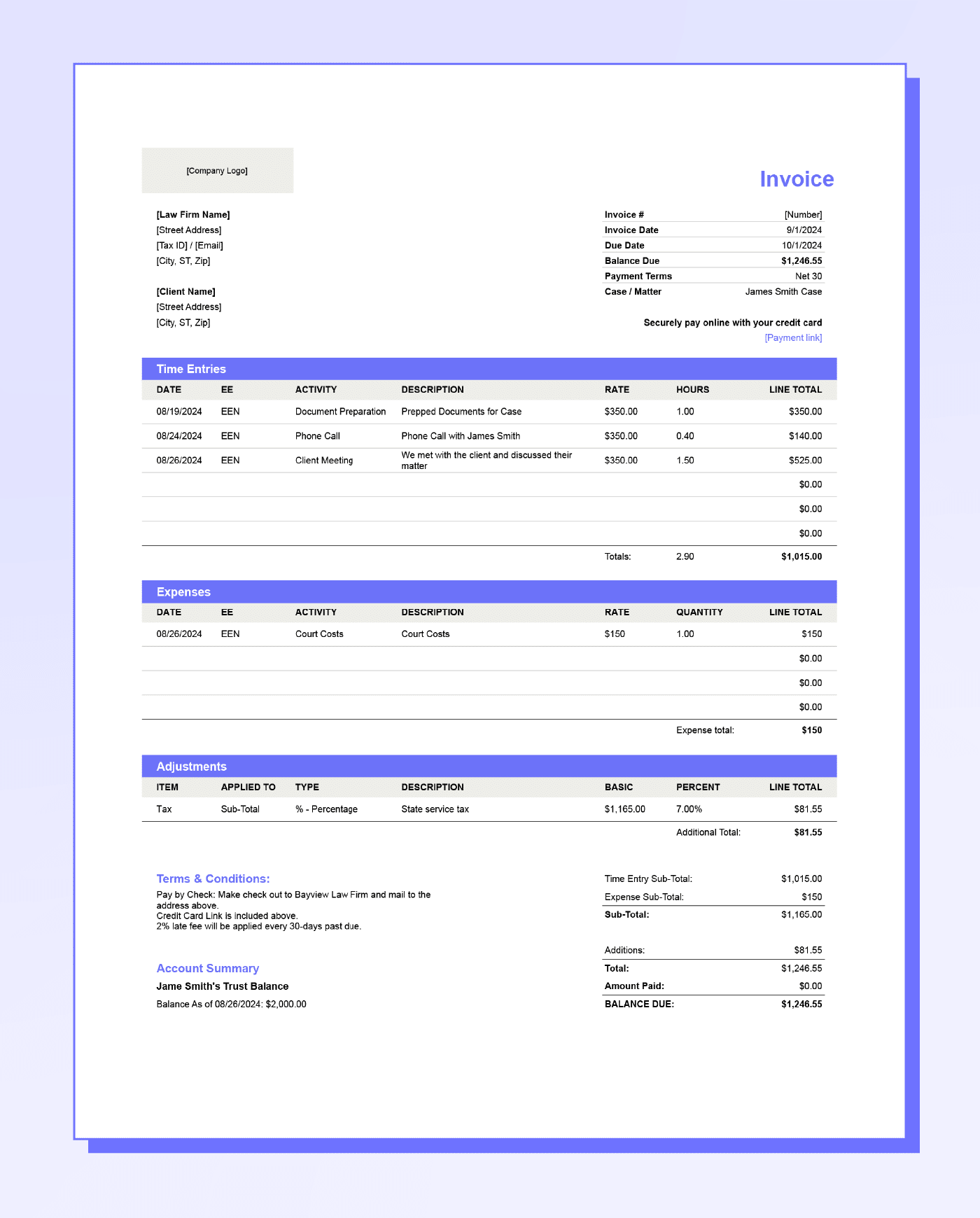

Legal Billing Entry and Statement Example

An effective legal billing statement is easy for anyone to understand. Clients can understand how much they’re charged, what the charge is, and the billable activity associated with the charge.

Legal billing statements typically include the follow:

Client’s name, address, phone number, and email address

Law firm’s name, address, phone number, and email address

Invoice issue date

Itemized lists of services, billing descriptions, and costs

Expenses and descriptions

Totals for each service

Subtotal for all services

Adjustments

Final total

Due date and late fee penalties

Payment methods

Trust account balance, if applicable

Sample Attorney Billing Descriptions

Billing descriptions are especially helpful for communicating each charge’s purpose. However, manually typing billing descriptions for similar tasks can take time away from more crucial work. It also creates inconsistencies across tasks and clients—making comparing work and analyzing time and expenses difficult.

Using succinct and consistent descriptions eliminates these issues and makes it easier to scale as your law firm grows. Below are sample attorney billing descriptions for common routine activities:

Case prep: Investigation and discovery of new information pertaining to the case

Collecting documents for trial: Review, analyze, and edit trial documents

Consultation fee: Cost of initial consultation

Court appearance: Attendance at trials, court hearings, or other proceedings

Client counseling: Client guidance

Billing Codes

Law firms can also use legal billing codes to help further streamline and organize billing entries. Many corporate clients require law firms to use Uniform Task-Based Management System (UTBMS) codes and follow the Legal Electronic Data Exchange Standard (LEDES) billing process. Visit the UTBMS and LEDES sites for more information.

You can also create your own internal codes for your law firm. For example, you can assign clients a specific code to more quickly items related to their case.

Legal Billing Template

A template can help your law firm standardize the look and information included in all invoices. Download our sample legal billing template to get started and check out our other legal invoice templates for more options.

Note: You must be logged into a Google Account to open and make a copy of the Google Sheets template.

Consistently Send Invoices

One of the biggest challenges in legal billing is actually getting bills out of the proverbial door. Law firms, especially those using outdated software, sit on bills for months—leading to weak cash flows and unnecessary effort towards collections down the line.

For many law firms, a good rule of thumb is to get legal billing out the door every month. If your law firm struggles to prepare invoices each month, consider billing every week or every two weeks. Billing in shorter time frames means your law firm has less to keep track of between billing cycles. The increased frequency can also help your law firm stay accountable with time and expense tracking. Smaller billing increments also mean smaller bills, which can be easier for clients to pay. Some law firms have even moved to subscription pricing on a monthly or annual basis.

Furthermore, as your caseload increases, it may negatively impact your timekeeping and billing. Instead of missing out on billable time, use software like MyCase, which allows you to:

Automatically generate an invoice with all time entries, expenses, unpaid balances, and applicable adjustments.

Set your preferred billing cadence and how often you want to send these automated billing reminders.

Pull up a list of all of your invoices to show all of your billable time for all matters.

Most firms send out invoices for multiple matters on the same schedule, also known as batch billing. From your list of invoices, you can select all the outstanding ones you want to send out and set up billing parameters to apply collectively to all of them—including due dates, payment terms, and other standard language that appears on your bills.

When you have a particularly large caseload, batch-billing can save you dozens of hours each month on invoice preparation between you and your team.

6. Establish a Clear Collections Process

Creating and sending invoices on time is only half of the process. The other half is payment collection.. Communicating early with clients, offering multiple payment methods, and sending clear invoices all contribute to streamlined payments.

However, a clear collections process can help avoid potential confusion and communicate responsibilities (and consequences) to your law firm and clients. Keep these best practices in mind when establishing your collections process.

Decide how you will handle late bills, such as past-due additional percentage charges and if you will cease work until you’ve received payment.

Set a deadline for sending bills to collections.

Establish a billing dispute process, including the steps your law firm will take, evidence your law firm will produce, templated emails and messaging, and who is responsible for each step.

Communicate billing terms during intake meetings so clients can ask questions and share extenuating circumstances early.

Set up automated reminders to inform clients of upcoming invoices, remind them when payments are due, and inform them when invoices are past due.

Include agreed-upon billing terms in each invoice to ensure clients have this information accessible.

7. Keep Up With Routine Reporting

Ensure that your law firm’s billing process is as efficient and effective as possible by analyzing your firm’s financial and billing information. This is performed by running reports that provide you with an overview of your law firm’s billing, invoicing, and collection data.

Depending on the software you use, you may have the following types of law firm reports available to you:

An aging invoice report, which shows overdue balances grouped into 1-15, 16-30, 31-60, and 61+ days overdue.

An accounts receivable report details your law firm’s receivables and can be filtered to show a particular client or case. You can also choose various grouping options to better format the data for your law firm’s specific needs.

A case revenue report, which shows cases billed during a certain period. It also lets you compare earnings on those cases during that same timeframe.

A fee allocation report, which displays amounts billed and collected by specific users at your firm during a certain period.

A user time and expenses report, which provides time and expense entries for a particular employee of your firm.

A case time and expenses report, which provides time and expense entries for a particular case/matter.

A trust account summary report, which shows all contacts with trust balances, including total credit, total debits, and “as-of” balance.

A trust account activity report, which displays a chosen client’s trust account activity.

A non-trust retainer and credit account summary report, which provides an overview of all contacts with non-trust retainer and credit balances as of a specified date.

A non-trust retainer and credit account activity report, which shows a client’s non-trust retainer and credit account activity.

A case list report, which displays cases based on case status (open/closed) and practice area. You can also group cases by practice area, firm user, client, and fee structure.

A statute of limitations report, which shows pending and expired statute of limitations deadlines for all firm cases or those assigned to a single attorney.

An electronic payments report, which shows all payment activity made via eCheck and credit card within a specified period.

A credit card fees report, which offers a detailed view of which fees are taken from the operating account.

8. Finalize Legal Billing Guidelines for Your Team

Automation and software can save your team a significant amount of time. However, questions may still arise about the software itself and processes outside of your tools. Internal legal billing guidelines can help your team troubleshoot and answer frequently asked questions independently.To get started, consider these questions:

What software-related billing questions does your team ask most frequently?

Where do the most errors arise in the billing and invoicing process?

What processes take up too much time?

What supplemental resources can minimize questions and help your team work more independently?

Below are resources to include in your guidelines:

SOP with step-by-step instructions for submitting time, invoicing, reviews, and other processes

Points of contact for approvals,and when they should be contacted

Legal billing and invoice template(s)

Communication templates

Sample attorney billing descriptions

List of expenses that your law firm can bill to clients

Glossary of common billing terms

FAQ section

Links to your software’s support or learning center

Plan to build out these resources as you build out each stage of your legal billing process. Creating these in tandem can save time and feel less overwhelming (compared to creating guidelines at the very end).

9. Create a Clear Billing Policy for Clients

Once you’ve established your internal process, create a simple client billing policy. Crafting these terms helps clients understand expectations and gives you both a point of reference in case questions or disputes arise.Create an easily customizable template and plan to include the following information:

Billing schedule

Timeline for payments

Frequency of payment reminders and follow-ups

Explanation of billing terminology

Available payment methods

Who to contact for questions

Consequences for late or non-payments

Examples of potential billable activities to expect

Learn how to modernize your billing practices to improve collection rates and optimize the client experience.

Webinar

Watch Now

10. Build in Time to Manage Billing and Invoicing

Whether you have an internal team managing billing, outsource to an agency, or manage it yourself, you must set aside time to manage the legal billing process.

Below, we’ll recap tips we’ve mentioned throughout this guide and others to help your law firm stay on top of billing and invoicing.

Create checkpoints with outsourced or internal billing teams to improve transparency and ensure they have the information they need.

Include client billing guideline reviews as part of the intake process to ensure all clients are aware of the terms and can raise questions or concerns early, if needed.

Set guidelines for adjusting rates to maintain flexibility while protecting your firm’s bottom line. Account for additional time needed for unique billing scenarios.

Invest in staff training for all billing processes to address common questions and encourage uniformity across the team.

Define a clear invoice review process to avoid bottlenecks and ensure invoices are sent on time.

Dedicate a set amount of time each week to review time tracking, expenses, and upcoming or outstanding bills. This helps you stay on track while staying within a limited number of non-billable hours.

Spend time (at least quarterly) to review financial reports, find areas of improvement, and see how your law firm is tracking against your financial goals.

Schedule regular client account and billing updates so clients are always aware of their account’s status.

Invest in comprehensive legal e-billing software to automate tedious processes and easily give your law firm a high-level look at your finances.

11. Find a Legal Billing Solution

Legal technology has been getting better at a rapid rate. If you want easy legal billing, your best course of action is to select legal software that integrates financial management with practice management. If your software is not siloed, you’ll be more efficient, make fewer mistakes, and save money on technology—while maximizing revenue.

MyCase’s comprehensive law practice platform makes billing easy by:

Including invoicing, automated reminders, payment reconciliation, and everything in between on one platform

Linking your most important data to your most important people: your staff, primary vendors, and clients

Auto-starting timers and surfacing the day’s billable activities to prevent lost time

Allowing firms to customize time tracking for billable and non-billable work

Automatically generating invoices using a client’s associated time tracking and expense data

Allowing easy payment collection by offering online payments, legal fee financing, and customizable payment pages

Generating in-depth reports to track financial performance and assist with creating a more streamlined law firm accounting system

Grow Your Law Firm With Better Billing

Now more than ever, law firms are looking for new ways to reduce costs, streamline workflows, and provide better value to their clients. However, the everyday tasks of billing, invoicing, and timekeeping take up a sizable amount of time, especially when it requires toggling between multiple systems to get the job done.

Fortunately, by re-evaluating your firm’s tools and workflows, you can get all three tasks done without any hassle.

Whether your biggest obstacle is keeping up with billing, collecting payments, or both, MyCase’s legal billing and invoice solution gives you the tools you need to set yourself up for success.

Try MyCase legal invoicing software risk-free with a 10-day free trial.

About the author

Adrian AguileraSenior Content Writer

Adrian Aguilera is a Senior Content Writer and SEO Strategist for leading legal software companies, including MyCase, Docketwise, and CASEpeer, as well as LawPay, the #1 legal payment processor. He covers emerging legal technology, financial wellness for law firms, the latest industry trends, and more.