Managing law firm expenses is vital for understanding your firm’s financial health and optimizing profitability. However, the distinction between hard costs and soft costs can often lead to confusion. This understanding is crucial for legal professionals to gain a comprehensive view of the firm’s financial operations and ensure its sustainability for long-term success.

In this article, we’ll explore the nuances of these cost categories—empowering you to make informed decisions, develop sound financial planning strategies, and ultimately improve your firm’s bottom line.

Types of Law Firm Expenses

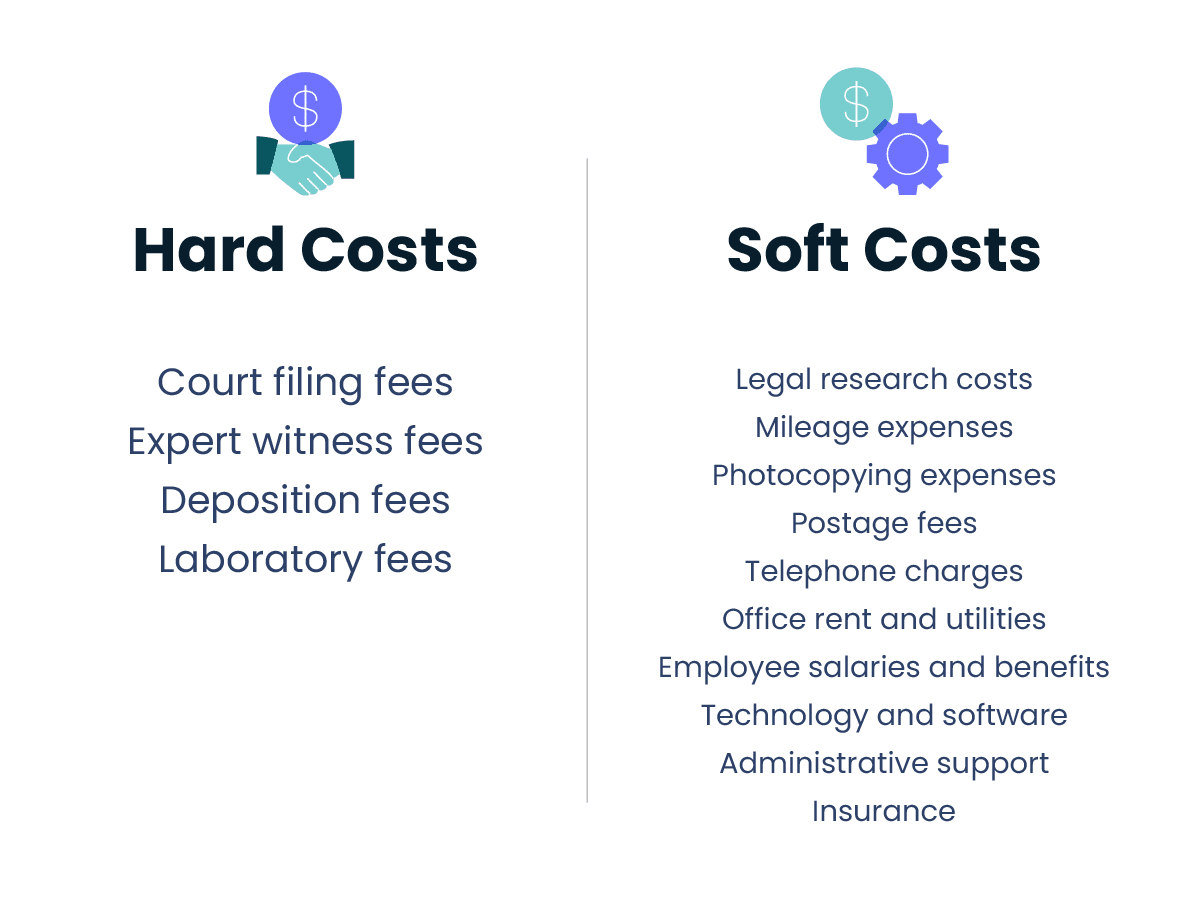

Law firm expenses can be broadly categorized into two main groups: hard costs and soft costs.

Let’s explore how these two law firm expenses differ.

Hard Costs

Hard costs are expenses that are paid upfront and directly to a third-party vendor for services rendered on behalf of a client matter.

Hard costs are expenses that are paid upfront and directly to a third-party vendor for services rendered on behalf of a client matter. These costs are associated with tangible expenses necessary for legal service delivery, such as:

Court filing fees

Expert witness fees

Deposition fees

Laboratory fees

Hard costs are typically viewed as necessary expenses by clients and are, therefore, more readily reimbursed.

Accurate and detailed recording of hard costs is essential for effective financial management and billing, but it can be a time-consuming endeavor. Fortunately, there are ways to streamline and automate the process—legal billing software that includes expense tracking functionality, such as MyCase Smart Spend, allows you to categorize all law firm expenses, enabling you to map each cost in real time. This is the first spend management software designed for the unique needs of law firms.

Soft Costs

Soft costs, on the other hand, are expenses that do not result in a direct payment to a third-party vendor.

Soft costs, on the other hand, are expenses that do not result in a direct payment to a third-party vendor. These costs typically revolve around resources used in legal practice, such as:

Legal research costs

Mileage expenses

Photocopying expenses

Postage fees

Telephone charges

They can also include the following overhead expenses:

Office rent and utilities

Employee salaries and benefits

Technology and software

Administrative support

Insurance

Although soft costs are billable to clients, there can be more resistance to paying for this type of cost. Clients may argue that law firms should absorb these costs as necessary expenses of doing business. It’s up to your firm to effectively manage soft costs and communicate billing processes to clients.

Legal billing software with built-in expense management tools can aid in this process. With MyCase Smart Spend, it’s easy to link expenses to client cases—even for lawyers on the go. You can upload a picture of the receipt, add a description, and automatically add the reimbursable expense to a client’s invoice.

Why Your Firm Needs a Spend Management Strategy

Developing and implementing a spend management strategy is crucial for the long-term success of your law firm. Without it, your firm may face challenges related to financial mismanagement, overspending, and reduced profitability.

Here are three main benefits of law firm spend management:

1. Greater Peace of Mind

By closely monitoring and controlling your law firm’s budget and expenses, you can gain a deeper understanding of your overall financial health, identify areas for improvement, and make more informed decisions. This level of financial clarity can provide you and your team with a greater sense of confidence and security, allowing you to focus on delivering exceptional legal services to your clients.

2. Increased Law Firm Profitability

Effective expense management can have a direct impact on your firm’s bottom line. By identifying and reducing unnecessary or excessive spending, you can optimize your firm’s financial resources and reinvest in areas that drive growth and profitability. This may include talent acquisition, technology upgrades, or strategic marketing initiatives.

By identifying and reducing unnecessary or excessive spending, you can optimize your firm's financial resources and reinvest in areas that drive growth and profitability.

It’s also important to remember that managing law firm finances is not simply about cutting costs; it’s about strategically allocating resources to maximize the return on investment (ROI). This approach ensures optimal resource utilization, driving cost savings and sustainable revenue growth.

3. Reduced Financial Risk

Proactive expense management can help your law firm mitigate financial risks, such as unexpected cost overruns, cash flow disruptions, or budget shortfalls. By having a clear understanding of your firm’s expenses and implementing effective cost-control measures, you can better prepare for and navigate any financial challenges that may arise.

How to Manage Law Firm Expenses

To effectively manage your law firm’s expenses, consider implementing the following strategies:

1. Reduce Office Rent Costs

Carefully evaluate your firm’s office space needs and consider options to reduce rent expenses. Start by assessing the use of your current space and determine if downsizing is a feasible option. You can also contact your landlord to explore lease renegotiations or potential rent reductions. Additionally, consider remote or hybrid work arrangements for your team. This approach reduces the need for extensive office space while maintaining productivity and providing an employee perk.

2. Invest in Efficient Marketing Channels

Analyze the ROI of your firm’s marketing efforts and focus your resources on the most effective and cost-efficient channels.

Digital marketing is often the most effective and cost-friendly approach. Consider allocating your marketing budget toward search engine optimization (SEO), content marketing, and social media campaigns. You can also run targeted ad campaigns, which allow you to focus on specific demographics and interests.

Finally, attend networking events where you can generate leads or referrals from other legal professionals.

3. Brainstorm and Budget Firm Expenses

Regularly review and update your law firm’s budget, taking into account both hard costs and soft costs. Foster a culture of financial awareness and encourage your team to contribute ideas for expense reduction or optimization. You can achieve this by holding regular meetings to discuss cost-saving initiatives and explore solutions.

By involving your entire team in the law firm budgeting process, you can gain valuable insights and ideas that lead to expense reductions without compromising the quality of your services.

4. Use Legal Expense Management Software

Leverage a spend management solution, like MyCase Smart Spend, to streamline your law firm’s financial planning and expense management. This tool (the first spend management solution of its kind for law firms) can automate expense tracking, reporting, and budgeting processes, saving significant time and effort. It can also provide valuable insights into your firm’s financial health, allowing you to make informed, data-driven decisions.

MyCase Smart Spend integrates with your accounting system and offers advanced features like customizable expense categories, real-time reporting, and the ability to allocate expenses to specific matters or clients.

Grow Your Profitability With MyCase Spend Management

In conclusion, effective spend management is vital for the financial health and profitability of your law firm. By implementing the strategies above, you can optimize your firm’s resources and keep track of every dollar spent.

Additionally, leveraging a spend management solution like MyCase Smart Spend enables you to gain better financial oversight with streamlined expense tracking. MyCase allows you to upload receipts, assign expenses to client cases, generate invoices, and centralize important case details all in one place.

To see how MyCase can revolutionize your spend management practices and boost your firm’s profitability, schedule a free demo today.

About the author

Gabriela JheanContent Writer

Gabriela Jhean is a Content Writer for leading legal software companies, including MyCase, Docketwise, and CASEpeer, as well as LawPay, the #1 legal payment processor. She covers emerging legal technology, financial wellness for law firms, the latest industry trends, and more.