You’ve finally found time to review your law firm’s timesheets. The only problem? Each entry looks drastically different.For example, recording thirty minutes can vary depending on the person and their preferred format, like:

.5

30

Half an hour

10 p.m.-10:30 p.m.

Tracking time is already challenging, especially without time-tracking software—a tool nearly one-third of law firms don’t use, according to our 2024 Legal Industry Report. Spending time deciphering handwritten notes and converting several time entries adds even more unnecessary administrative time to your day.

With an attorney billable hours chart, you’ll have a standardized system to efficiently record all billable work. Paired with helpful software tools, your firm can enhance productivity, improve cash flow, and delight clients.

This article covers how to use a lawyer’s billable hours chart, the differences between billable and non-billable hours, and best practices for tracking time and maximizing billable hours.

What Is a Billable Hours Chart?

An attorney billable hours chart is a tool that converts minutes into standardized time increments. For example, a chart can require you to record tasks taking 0-6 minutes as “.1” in your timesheet.

This chart helps law firms streamline time entries for more accurate billing and easier invoicing. Analyzing uniform records also supports financial reporting and major decision-making.

For example, you can use time-tracking trends for specific cases and tasks to determine your law firm’s hourly rate. Timesheet entries can also help you calculate your team’s utilization rate to decide the best way to allocate resources.

Why Lawyers Bill in 6-Minute Increments

Recording time to the minute is tedious, requires precise time tracking, and can take time away from client work. Block billing is another billing practice that can be detrimental. Since block billing uses large time ranges, this method results in overcharging the client. For example, rounding 30 minutes up to one hour inflates a client’s costs.

Therefore, most lawyers calculate billable hours in one-tenth-hour increments. This results in six-minute time frames. Billing with six-minute time increments simplifies tracking and makes it easier to accurately record time.

Attorney Billable Hours Example Chart

Law firms use legal billable hours charts to illustrate how to convert time increments for time-tracking purposes. The attorney billable hours example below illustrates how to bill in tenths.

Tenths Conversion | Time Increment |

0.1 | 1-6 minutes |

0.2 | 7-12 minutes |

0.3 | 13-18 minutes |

0.4 | 19-24 minutes |

0.5 | 25-30 minutes |

0.6 | 31-36 minutes |

0.7 | 37-42 minutes |

0.8 | 43-48 minutes |

0.9 | 49-54 minutes |

1.0 | 55-60 minutes |

Billable vs. Non-Billable Time

In addition to tracking time correctly, law firms must also accurately separate billable and non-billable work.Billable time encompasses all the time you spend on casework and must bill back to the client. Examples include:

Case-focused research

Drafting of pleadings

Court appearances

Client meetings

Non-billable time typically involves clerical tasks that require no legal skill. Law firms take on the cost of these functions and should not bill clients. Examples include:

Invoicing

Client meeting scheduling

Closing files

Managing timesheets

High non-billable hours signal that it’s time to re-evaluate processes and invest in time-saving software.

MyCase’s practice management software combines case and business management to optimize all aspects of your law firm’s operations—so your firm can focus more time on billable work.

For example, law firms can use MyCase’s case management features to easily create documents and templates, automate workflows, and simplify calendaring. They can also use MyCase’s financial management solutions to gain access to financial reporting tools, end-to-end legal accounting support, and an integrated spend management system.

Use our time-savings calculator to learn how much time you can save with MyCase’s comprehensive practice management solution.

How Do Attorneys Calculate Billable Hours?

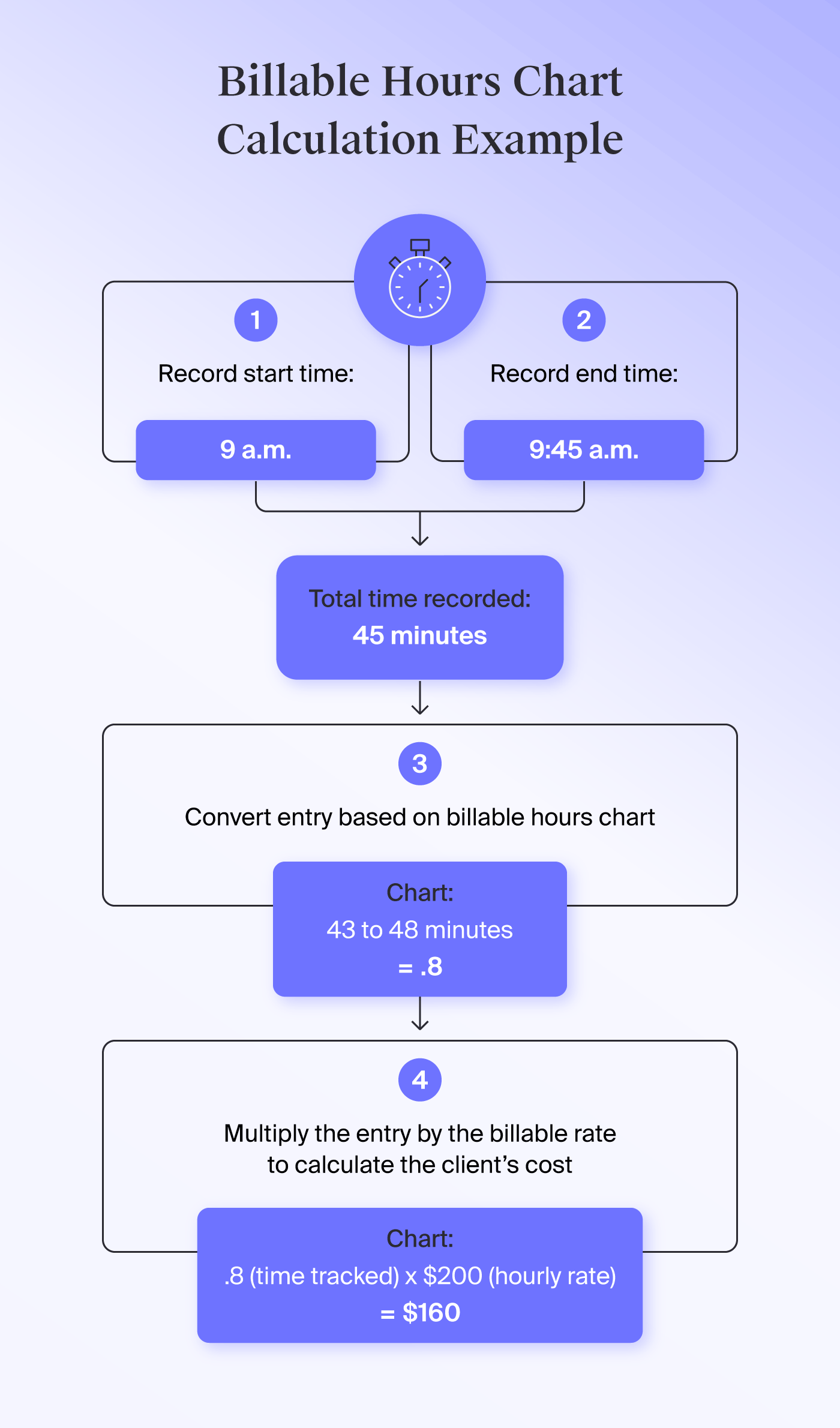

To calculate billable hours using a chart, accurately track time and then use the chart to create a time entry. Next, multiply that entry with your billable rate to calculate the client’s cost.

We’ll use a simplified example to explain how to convert 45 minutes using a lawyer billable hours chart.

A lawyer begins a task and records the start time or starts their timer at 9 a.m.

A lawyer completes the task and records the end time or stops their timer at 9:45 a.m.

A lawyer looks at their legal billable hours chart to confirm the 45-minute conversion. The chart lists “.8” as the time entry.

A lawyer multiplies .8 by a $200 hourly rate to calculate the rate for that task, which is $160.

Although this process seems manageable, most lawyers tend to work on several tasks at one time. If your law firm does not use software, managing multiple simultaneous tasks requires detailed and constant tracking.

MyCase’s platform offers time-tracking features for lawyers that automate this entire process. Lawyers can start up to three timers at once to capture time while they work. The platform also automatically tracks time spent on calls and emails. Once captured, the tool uses this data to automatically generate invoices—no manual calculations are required.

MyCase’s Smart Time Finder tool also helps prevent lost billable work. This feature shares a list of common billables with you so you can record time for tasks you may have missed. According to our 2024 Legal Trends Report, our customers logged an additional 579,665 hours, amounting to about $22,425 in billable hours per lawyer.

Can an Attorney Deduct Billable Hours From Charity Work?

Attorneys cannot use their time and labor aiding a charity (at a billing rate) as a tax deduction. However, certain qualifying expenses incurred while volunteering legal services are eligible for a tax break.

For example, this could include:

Unreimbursed office supplies, filing fees, or postage

Advertising and broadcasting fees benefiting the charitable organization

Certain traveling expenses to and from non-profit activities

As a rule of thumb, keep all receipts if your law firm is claiming tax deductions that year. Request official receipts from non-profit clients as extra insurance. Before attempting deductions, speak with a tax advisor as a safety precaution.

Time Tracking and Billing Best Practices

Following an organized lawyer’s billable hours chart can help keep your law firm’s invoices neat and standardized—while effectively detailing all client costs.Below are best practices your law firm can follow to efficiently track time and bill clients:

Share billing policies with clients before beginning legal work to ensure they understand how they’re billed.

Track in real-time to hold yourself accountable for recording billables and encourage staff to do the same.

Write succinct, detailed, and jargon-less descriptions for each entry so clients understand what they’re paying for and how the task relates to their case.

Establish sample attorney billing entries to save time from manually writing descriptions for each entry.

Create guidelines to distinguish and track billable and non-billable work.

Consider alternative billing methods to give clients more flexibility. These include flat fees, contingency fees, and retainers.

Regularly review time entries to find discrepancies and make adjustments as needed.

Evaluate timesheets for trends that can inform operational changes.

Train your team on time-tracking and time management best practices to maximize billable hours. Provide them with an easily accessible copy of your billable hours chart.

Use the same law firm time tracking template across your law firm to ensure easier logging and analysis.

Use time-tracking software that’s integrated with your practice management platform to automate time tracking and invoicing.

Learn how to modernize your billing practices to improve collection rates and optimize the client experience.

Webinar

Webinar

What’s the Best Method for Tracking Billable Time?

Time tracking software is the best method for tracking billable time. Although attorneys can also track billables by logging them by hand or using a lawyer timesheet template, these manual methods can be challenging to use throughout a lawyer’s average day.

Lawyers are constantly on the move and often work on multiple cases simultaneously. Focusing on legal work makes it easy to forget to write down time entries or log time in a spreadsheet. As a result, tracking billable hours is often left for the end of the week—or worse—the end of the month. Attorneys are left scrambling, reviewing, and attempting to remember all billable tasks that were performed.

Fortunately, streamlining the time tracking process with a billable hours chart and software can help law firms prepare fair and accurate client invoices, save time, and track more billable hours. According to our 2024 Legal Trends Report, 78% of law firms used time-tracking software to capture additional billable hours each week.

Time-tracking tools can also automate other tedious processes. For example, you can build in sample attorney billing entry descriptions that can auto populate for common tasks.

Simplify Billing Entries with Legal Billing Software

MyCase’s legal billing tools make it easy to track billable hours and ensure they comply with your billable hours chart. Time is readily incorporated into the software and automatically separated by case.

The software also includes financial reporting to monitor aging invoices, gain insight into payments billed and collected, track active payment plans, and more.

Try MyCase today risk-free with a 10-day free trial, or explore monthly and yearly subscriptions.

About the author

Adrian AguileraSenior Content Writer

Adrian Aguilera is a Senior Content Writer and SEO Strategist for leading legal software companies, including MyCase, Docketwise, and CASEpeer, as well as LawPay, the #1 legal payment processor. He covers emerging legal technology, financial wellness for law firms, the latest industry trends, and more.