For solo attorneys and small law firms, maintaining Form 1099 compliance is essential to running a successful practice. However, navigating the complexities of the IRS Form 1099 reporting process throughout the year can be challenging.

In this blog, you’ll learn the essential steps for preparing Form 1099 correctly. We’ll cover specific circumstances under which Form 1099 is required, such as a 1099 for attorney fees or payments to independent contractors, the differences between Form 1099-MISC and Form 1099-NEC, and common IRS Form 1099 errors and how to avoid them.

By mastering these concepts, you’ll be better equipped to ensure 1099 compliance with the IRS while avoiding costly penalties.

What is a 1099 Form, and How Is it Used?

Form 1099 is an important tax document used in the U.S. to report payments made to nonemployees, such as independent contractors, freelancers, and sole proprietors.

Form 1099 is an important tax document used in the U.S. to report payments made to nonemployees, such as independent contractors, freelancers, and sole proprietors. It provides a record of income earned by these individuals or their business entities and plays a key role in ensuring accurate tax reporting.

Accurate expense management and reporting are vital for law firms, as discrepancies between the amounts reported on a 1099 for attorney fees and the income declared by the vendor can trigger red flags for the IRS. This highlights the importance of providing precise and consistent information in every form.

Is a 1099 Form Required for Attorney Fees?

Any business making payments totaling $600 or more in a year for services must report these payments on Form 1099.

A 1099 for attorney fees is generally required for law firms. Any business making payments totaling $600 or more in a year for services must report these payments on Form 1099. This includes payments to attorneys, regardless of their business structure (e.g., corporation, LLC, partnership).

Understanding 1099 Compliance

Understanding when to issue a 1099 for attorney fees should be a part of your law firm’s financial strategy to ensure compliance with IRS regulations.

When to Issue Form 1099

Form 1099 should be issued to:

Contractors and service providers:

If you paid a contractor or service provider over $600 during the calendar year for nonemployee compensation, such as fees for services rendered, you must issue Form 1099-NEC. This includes payments made by check, debit card, or ACH. (Payments made by credit card are reported by the merchant process and do not count toward the threshold.)

If you paid a vendor or service provider more than $600 during the calendar year for things such as rent, royalties, prizes, and awards, you must issue Form 1099-MISC.

Law firms: Issue Form 1099-NEC to all law firms, regardless of their tax filing status.

Landlords: Issue Form 1099-MISC to landlords, regardless of their entity type.

In addition to traditional contractors, attorneys and law firms often work with other types of businesses that may require 1099 reporting, such as:

Legal support services: Payments to independent attorneys, paralegals, process servers, stenographers, private investigators, and similar professionals for services provided.

Expert witness fees: Payments to expert witnesses for their testimony or related services.

Research and consulting fees: Payments to individuals or firms for research or consulting services connected to legal cases.

When to Not Issue Form 1099

To avoid unnecessary paperwork and ensure proper compliance with IRS requirements, do not issue a 1099 for legal services:

To corporations: If a vendor’s W-9 indicates they file taxes as an “S Corporation” or “C Corporation,” they are exempt from receiving a 1099. This also applies to LLCs that have elected to be taxed as S Corporations.

To employees: Payments to employees should be reported on Form W-2, not a 1099.

To contractors paid via payroll: In these cases, the payroll company typically handles the issuance of 1099s. It’s a good idea to confirm this directly with your payroll provider.

For reimbursements: Do not include reimbursements for expenses like office supplies, meals, or travel when calculating a vendor’s total 1099-reportable compensation.

Consequences of 1099 Non-Compliance

Non-compliance with IRS Form 1099 reporting requirements can lead to significant financial and legal consequences for firms. Penalties for late or missing filings vary depending on the delay:

Filing 30 days late: $60 per form, up to $630,500 annually ($220,500 for small businesses).

Filing after 30 days but before August 1: $120 per form, with a maximum of $1,891,500 annually ($630,500 for small businesses).

Filing after August 1 or not filing at all: $310 per form, with a maximum of $3,783,000 annually ($1,261,000 for small businesses).

Intentional disregard: $630 per form with no maximum limit.

These penalties can quickly escalate, particularly for larger businesses, and may attract further legal scrutiny.

What is the Difference Between Form 1099-MISC and Form 1099-NEC?

While Form 1099-MISC and Form 1099-NEC are both IRS tax documents used to report types of income, both serve distinct purposes.

Form 1099-MISC is used to report miscellaneous income over $600 that’s not classified as employee compensation. This includes payments such as rent, royalties, prizes, awards, and certain types of medical and healthcare payments.

Form 1099-NEC (nonemployee compensation) is specifically designed for reporting nonemployee compensation, such as payments of $600 or more made to independent contractors, freelancers, or other nonemployees.

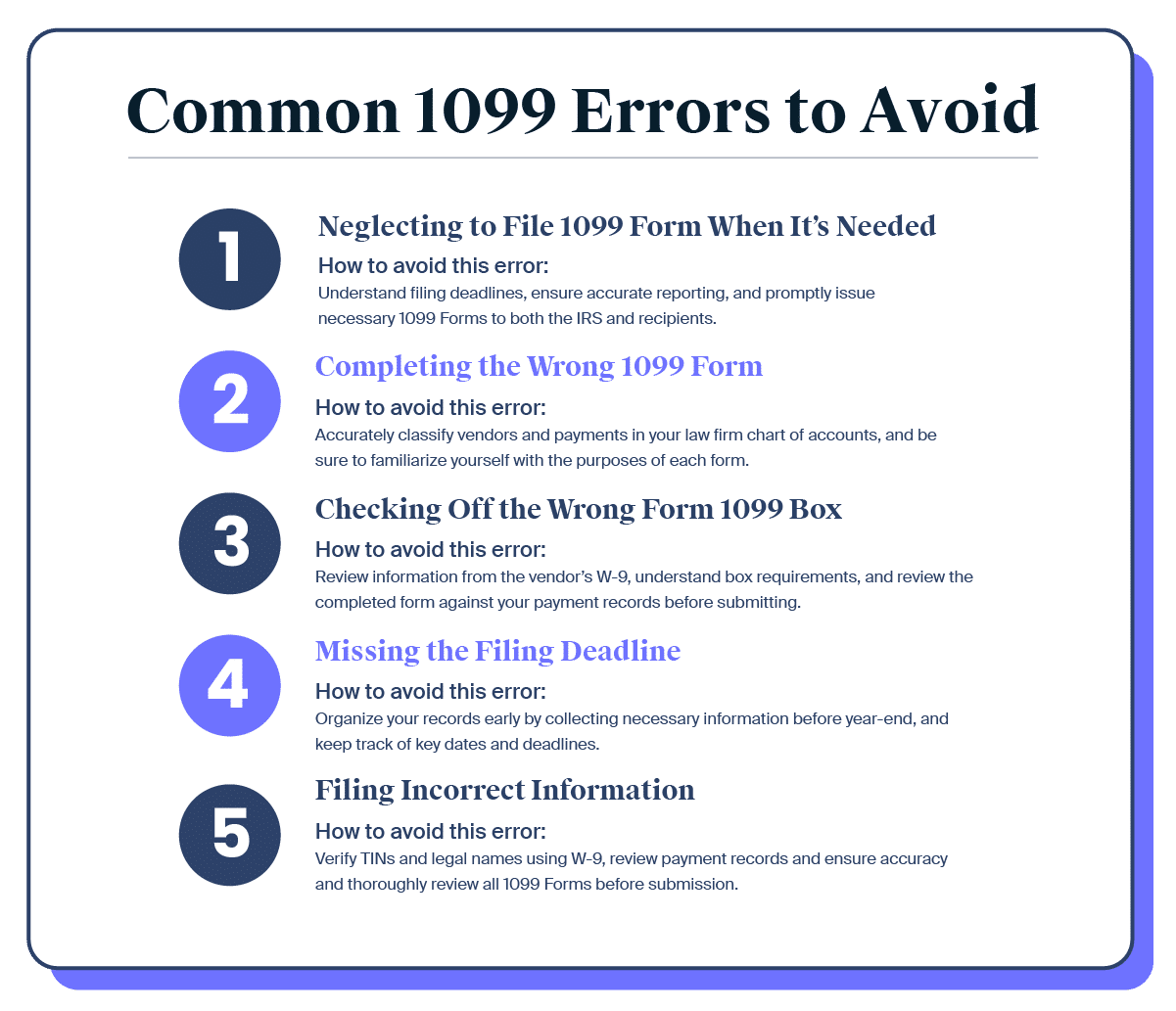

5 Common Form 1099 Errors to Avoid

Avoiding common errors when handling Form 1099 is crucial for maintaining compliance with IRS regulations. Here are the most frequent mistakes businesses make and practical tips to ensure accurate filing.

1. Neglecting to File 1099 Form When It’s Needed

Failing to file a 1099 for attorney fees when it’s needed can result in hefty penalties that are dependent on the length of delay.

How to avoid this error: Be sure to understand filing deadlines, ensure accurate information reporting, and promptly issue necessary 1099 Forms to both the IRS and recipients.

2. Completing the Wrong 1099 Form

Completing the incorrect variant of Form 1099, such as using Form 1099-MISC instead of Form 1099-NEC, can lead to processing errors and penalties.

How to avoid this error: Accurately classify vendors and payments in your law firm chart of accounts, and be sure to familiarize yourself with the purposes of each form. Consider requesting a completed Form W-9 from all vendors before making payments (the W-9 provides the vendor’s Taxpayer Identification Number (TIN) and entity classification, which guide the correct form selection).

3. Checking Off the Wrong Form 1099 Box

Checking the wrong box on a Form 1099 can lead to processing delays, IRS notices, and penalties for incorrect filing. This error can also cause confusion for the recipient, who may report incorrect income to the IRS, potentially triggering mismatches and audits.

How to avoid this error: Review information collected from the vendor’s Form W-9, understand box requirements, and review the completed form against your payment records before submitting.

4. Missing the Filing Deadline

Missing the filing deadline for a Form 1099 can result in penalties from the IRS that are dependent on how late the form is filed. In addition to financial penalties, late filing can lead to compliance issues and possible IRS scrutiny.

How to avoid this error: Organize your records early by collecting all necessary information (such as completed W-9 forms) before year-end, and keep track of key dates and deadlines:

January 31: Provide forms to recipients; file Form 1099-NEC with the IRS

February 28: Deadline for paper filing most other 1099 Forms with the IRS

March 31: Deadline for IRS 1099 electronic filing requirements

5. Filing Incorrect Information

Filing incorrect information (TINs, payment amounts, recipient names, etc.) on a Form 1099, can lead to recipient confusion as well as IRS penalties, notices, and audits.

How to avoid this error: Verify TINs and legal names using Form W-9, review payment records and ensure they’re accurate and clearly distinguish between reportable and non-reportable amounts, and thoroughly review all 1099 Forms before submission. If you discover a mistake after filing, promptly file a corrected form to both the recipient and the IRS.

Key Tips for Filing a 1099 Form

For legal professionals, filing a 1099 Form accurately is crucial to ensuring compliance with IRS regulations and avoiding penalties.

Begin by collecting completed Form W-9s from all potentially 1099-eligible vendors before paying their first notice. The W-9 provides essential information, such as the vendor’s TIN and tax classification, ensuring accurate reporting. Here is a downloadable W-9 form.

Even for vendors that are S or C Corporations (and typically not 1099-eligible), retaining their W-9 forms in your records is a good practice for documentation. If you have trouble obtaining a vendor’s W-9, make several documented attempts to contact them, such as via email, and save these communications to their vendor file as proof of due diligence.

If you discover incorrect information on a previously submitted 1099, report the correction to the IRS as soon as possible to avoid penalties. Finally, when in doubt about whether a worker qualifies as an employee or independent contractor, consult a tax professional for guidance to ensure compliance with IRS requirements. These proactive steps will help you manage your 1099 filing process effectively and minimize errors.

Easily Manage 1099 Forms With MyCase

While law firm accounting is a complex system for legal professionals, it’s a necessary part of the profession that helps ensure your firm is profitable. MyCase Legal Accounting is an easy-to-use accounting software built seamlessly into the MyCase practice management platform for maximum convenience.

With MyCase Legal Accounting software, your firm can streamline case data, and easily track 1099 Forms and eligible vendors.

With MyCase Legal Accounting software, your firm can streamline case data, easily track 1099 Forms and eligible vendors, and be audit-ready with features like 3-way trust reconciliation, IOLTA compliance, client billing, and firm accounting work.

To see how MyCase can help you easily manage 1099 Forms and boost your firm’s productivity, book a free demo today.

About the author

Sammi JonesSenior Content Writer and Editor

Sammi Jones is a Senior Content Writer and Editor for leading legal software brands, including MyCase, Docketwise, CASEpeer, and LawPay—the #1 legal payment processor. She covers the latest advancements in legal technology, financial wellness for law firms, and key industry trends.