Key takeaway

Trust accounting involves closely managing and tracking client funds under requirements from the American Bar Association (ABA) and local jurisdictions. General guidelines for all firms include:

Only accessing client trust account funds earned through billable work or used for client-related expenses like court filing fees.

Ensuring that funds from client trust accounts do not commingle with other accounts.

Upholding detailed and accurate records of all funds coming in and out of the trust account.

Now that’s quite a lofty title, right? Isn’t trust accounting supposed to be complex? Isn’t it the infamous process that trips up attorneys and bookkeepers new to legal accounting? Our 2024 Legal Industry Report found that more than 1 in 10 respondents find law firm accounting the most challenging function for their firm.

While the horror stories are true (usually negligent cases), you can get ahead of common issues by familiarizing yourself with the rules and streamlining processes as much as possible. This guide will go over the basics of trust accounting, share examples from MyCase reports, and go over rules and best practices for your law firm to follow.

What is a Client Trust Account, and What Are the Requirements?

A client trust account is a bank account that consists of money from the client (or awarded to the client) that is held as a trust.Money in a trust account can include:

Unearned retainer or flat fees

Disputed fees

Settlement funds

Court fees

Advanced costs

Money in this account belongs to the client, cannot be accessed unless earned through billable work or used for client-related expenses, and cannot commingle with any accounts. Below are examples from a couple of other common accounts:

Operating accounts pay for operating expenses. This can include salaries, rent, and utility bills.

Escrow accounts hold funds during transactions that neutral third parties manage. Examples include real estate deals or other business transactions. They’re similar to trust accounts but aren’t exclusively for client trust funds. Note that some institutions may refer to trust accounts as escrow accounts. Ask for clarity to ensure you’re opening the correct type of account.

Keep client trust funds separate from these and other non-client trust accounts to avoid accidental commingling or misuse of funds.

When creating a client trust account, you have the option between creating a pooled account or a separate account:

Pooled trust account: This is the most common method for storing client trust funds. One account is created to house all clients’ trust money. However, your firm is responsible for keeping track and managing the exact amounts that belong to each client—as well as any deposits and withdrawals. This is performed via accounting ledgers and records management.

Separate trust account: Firms can also create trust accounts for each client if they hold large sums of money, hold the funds for a long period, or if the client specifically requests it.

What is an IOLTA Account?

In addition to choosing the type of trust account to use, it’s recommended—and typically required to—open an account with a bank that participates in the Interest on Lawyer Trust Account (IOLTA) program.

IOLTA trust accounts earn interest that banks typically transfer automatically to your local Bar Association. The associations generally use these interest funds for activities such as civil legal services.

There are several other rules banks and firms must follow when managing IOLTA accounts. For example, banks should not charge bad check charges, maintenance fees, or other incidentals of the client’s trust money. Any such charges could result in sanctions for your firm. To help avoid this, seek bankers familiar with the IOLTA program.

Check the status of IOLTA programs in your state to see if you’re required to use one.

What is Trust Accounting?

Trust accounting involves overseeing, recording, and properly using client funds to cover client fees. Law firms must follow their local Bar’s rules for handling client trust funds. Mismanagement can result in fines or, in the most severe case, an attorney can lose their license to practice law.

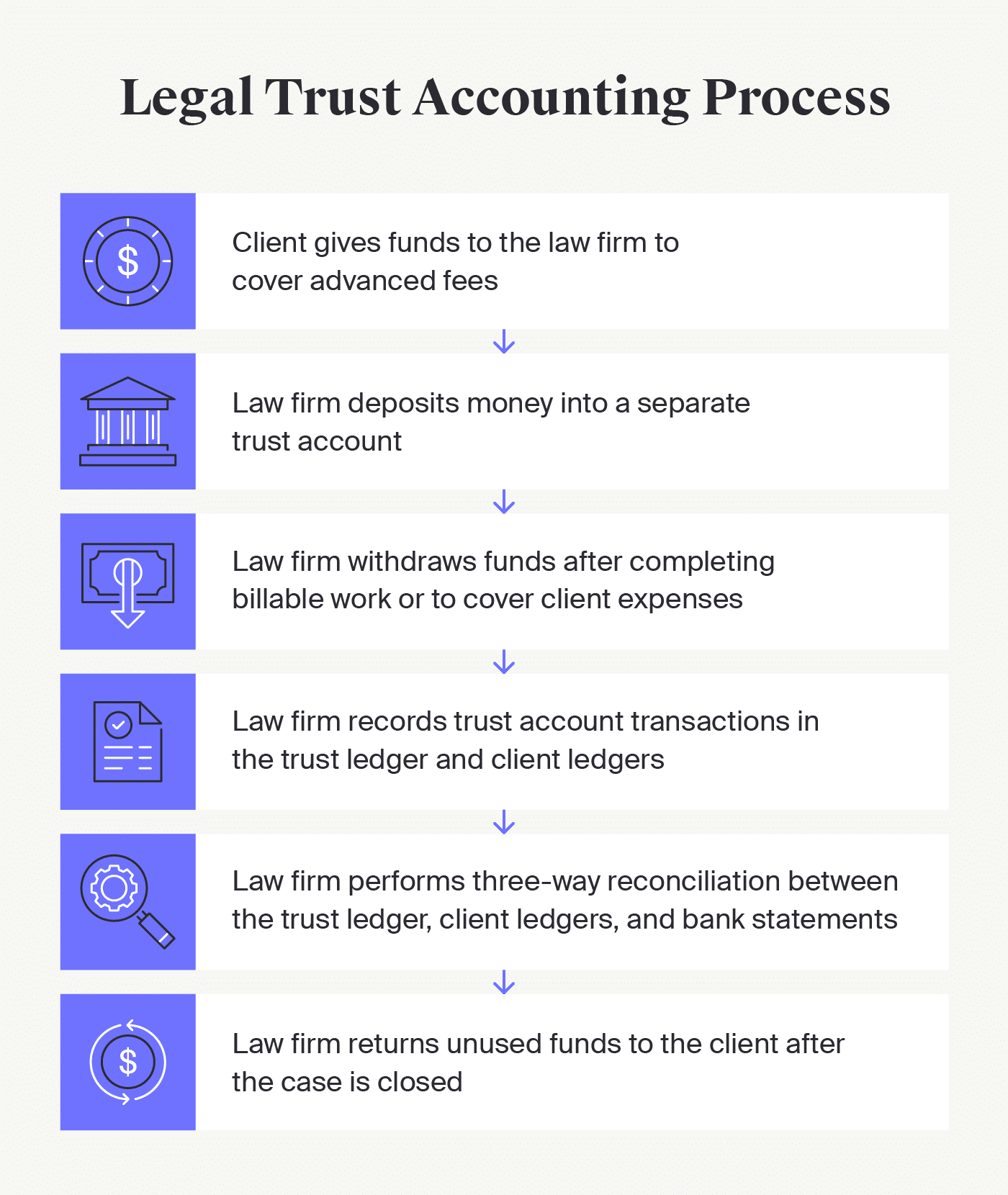

Below is how the trust accounting process typically works:

The client gives your firm money to use for expenses related to billable work.

Your firm deposits the money in either a pooled or separate trust account, depending on the quantity, the length of time you’re holding it, and the client’s preferences.

Your firm withdraws from the account after it is earned through billable work or, if needed, to pay required fees related to the client’s case. You may either use funds directly from the account or use money from your operating account, then invoice the client for those expenses.

Your firm maintains records for all trust accounts in the trust ledger and individual client ledgers.

Your firm performs three-way reconciliation at least quarterly (ideally monthly) to ensure the trust ledger, client ledgers, and bank statements match.

Your firm gives the remaining funds to the client after the case is closed, all fees are paid, and billable work is compensated.

You may be required to hold funds in the trust account if you’re handling fee disputes.

The best way to monitor trust accounts is to have complete visibility in the records. Since the receipt of trust funds or a retainer is a liability, you can break it down into straightforward entries:

Debit the trust bank account

Credit the trust liability account

Depending on the software used for law firm accounting, trust funds can be placed into one trust liability account and tracked by the customer name or any other preferred method.

For example, if you create sub-ledger accounts in your accounting software and track individual client registers using these accounts, the log could look like this:

Method 1: Pay Client Expenses From the Trust Account

Depending on the law firm and the local Bar rules, sometimes attorneys use the funds directly out of the client’s trust bank account to pay for client expenses.

The transaction will look like this if client fees are paid out of the trust bank account.

Debit the sub-liability account or ledger for the client or your parent account using the customer method described above.

Credit the trust bank account.

You would write a check out of the trust bank account and book it into the client sub-ledger. That would result in a decrease in the retainer funds or the upfront deposit.

Method 2: Pay Client Expenses from the Operating Account

Firms can also use their operating funds to cover client expenses and bill that back at the time of invoicing when the revenue is earned. That’s for the money in.

Debit into the advanced client cost account

Credit the operating bank account

The law firm’s client is typically invoiced either monthly or twice a month. Billing schedules depend on the firm and the practice area. If client expenses and fees are paid out of the operating bank account, they are billed back to the client during invoicing. Those expenses are added to any time the attorney tracked.

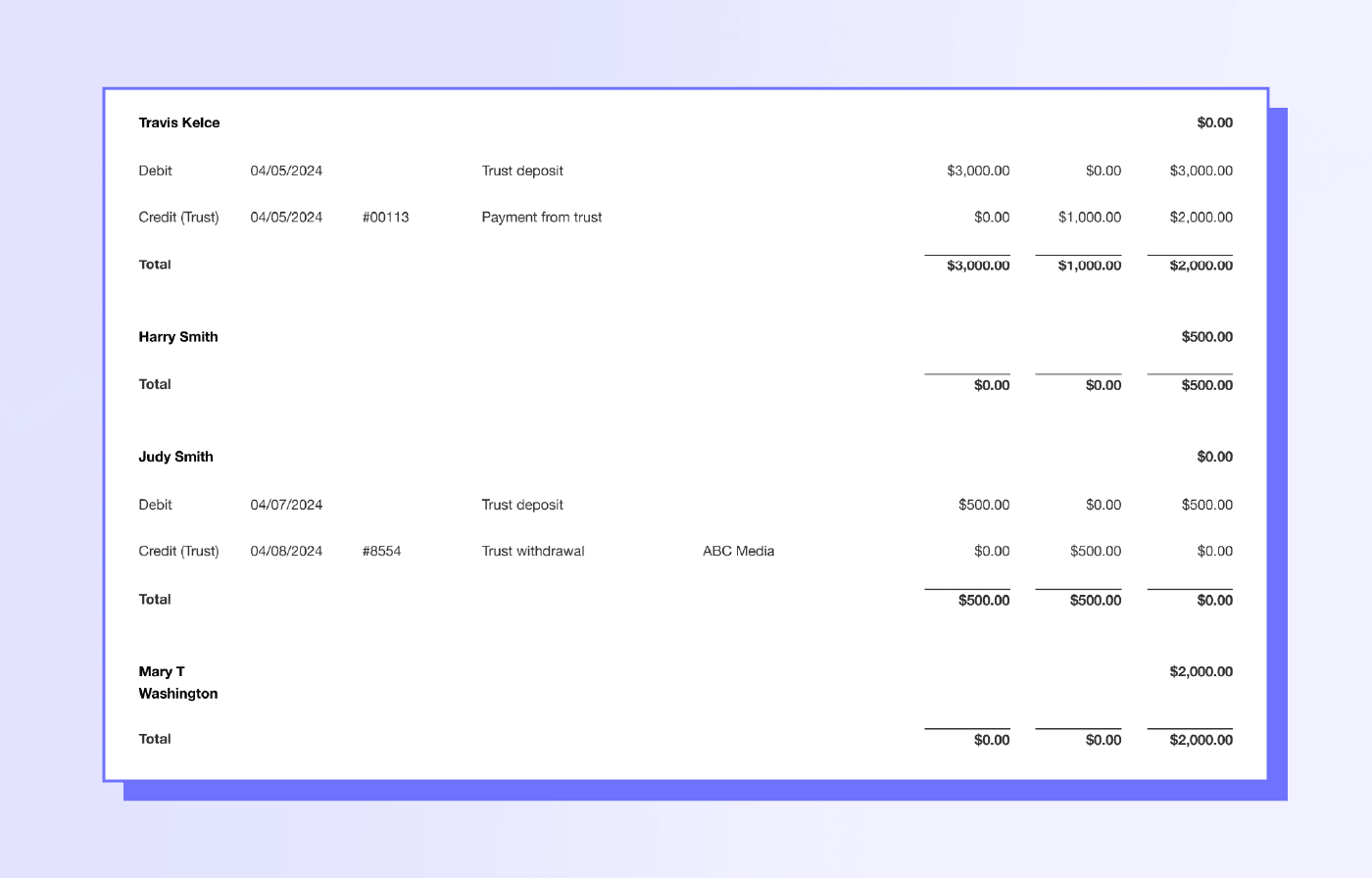

Trust Accounting Sample Report

Trust accounting records can vary between firms. To understand what it can look like, check out these trust accounting sample reports from MyCase below.

Download Trust Accounting Sample Report

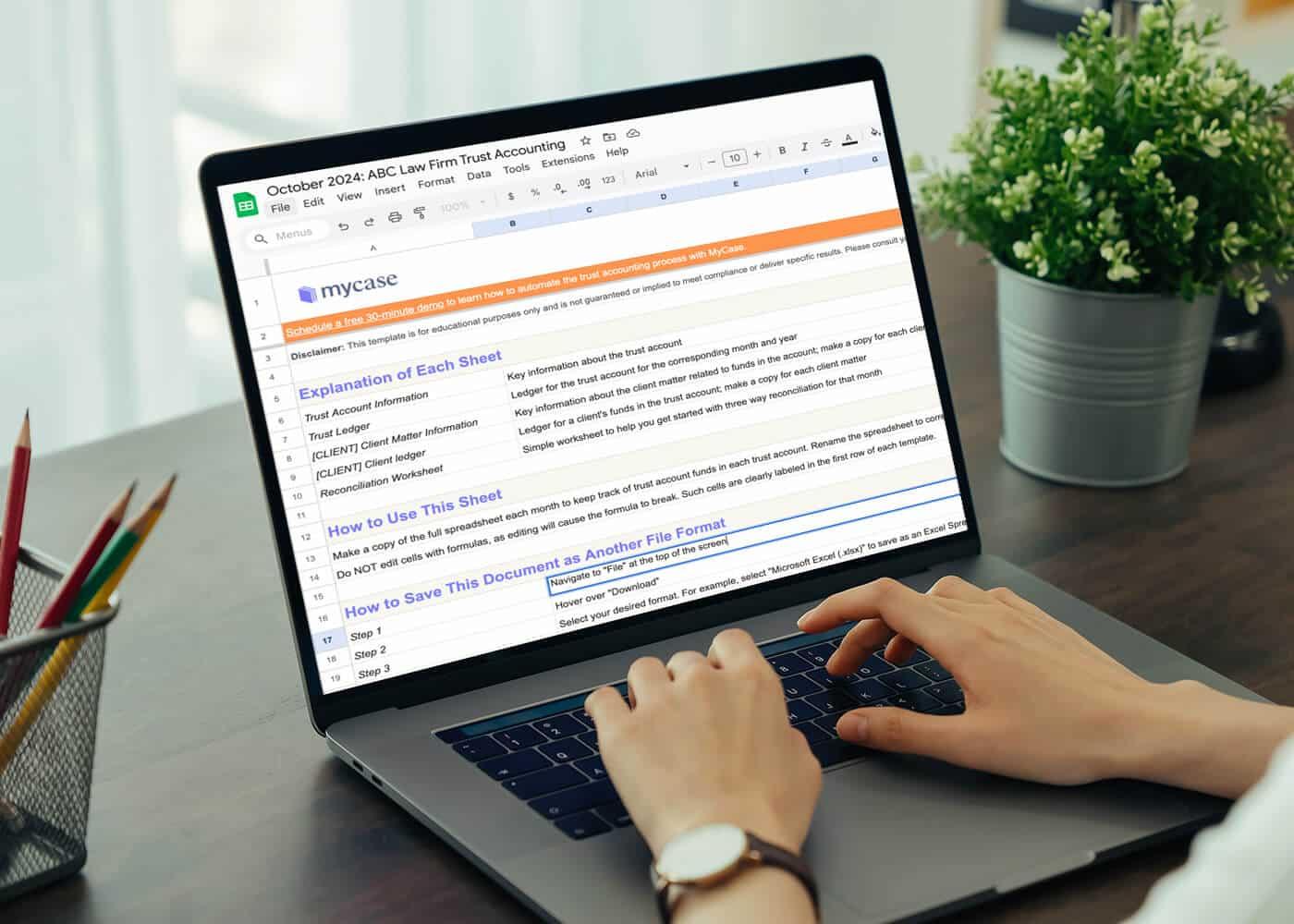

Trust Accounting Spreadsheet Template

To help you get started, we put together a simple trust accounting template. This is a starting point to streamline your trust accounting system. Adjust the template to comply with your firm’s trust accounting process and local regulations.

Disclaimer: This template is for educational purposes only and is not guaranteed or implied to meet compliance or deliver specific results. Please consult your local Bar Association and government entities to confirm requirements and adjust this template accordingly. Your local Bar Association may also have worksheets and templates that comply with regional requirements.

Note: You must be logged in to a Google Account to open and make a copy of the Google Sheets template.

Trust Accounting Rules and Best Practices

Setting up detailed and well-managed attorney trust accounting is crucial for maintaining compliance. It starts with properly opening and managing trust funds for each client and ensuring that money is only taken out when earned.

Each state also has different rules—some states even have rules that get further segmented by county. Hence, you must dig deep into what is expected of the attorney and the law firm.

Below, we’ll give a high-level overview of the ABA’s Model Rules on Client Trust Account Records to help you understand guidelines for all firms. After getting acquainted with these rules, we recommend looking up local Bar resources to learn about region-specific requirements.

Only Access Funds When Needed

Lawyers cannot use funds in trust accounts until they are earned through billable work or used to pay fees on a client’s behalf. For example, lawyers can use funds from this account to pay court fees for their client’s case. Lawyers can also transfer funds from trust accounts after they’ve completed legal services.

Establish systems with your staff to avoid improper funds usage. For instance, you can impose requirements for signed invoices or other approved documentation before making withdrawals or deposits.

Some state bars may have regulations that can reduce the burden of law firm trust accounting. For example, attorneys may be able to forgo trust accounts when storing client funds if the money is under a specified limit.

However, exercise caution when considering this option by contacting your local state bar association. This will ensure that any method you pursue to reduce trust account usage is within compliance.

Avoid Commingling Funds

Law firms should also keep trust funds separate to avoid misuse. To do so, you can store all physical client trust checks and deposit slips in a different location than checks for the firm’s operating account.

Maintaining a detailed legal chart of accounts can also help avoid issues. For example, client funds should not be reported as income until it is earned through billable work.

Understand the Types of Conversions that Require Recordkeeping

The ABA requires firms to maintain detailed recordkeeping for the following check conversions:

Point-of-purchase conversion is when the firm converts a paper check into a debit at the time of the purchase. Once debited, the firm must return the check to the issuer.

Back-office conversion is when the firm converts a paper check after it’s received at the point of purchase. The firm is responsible for destroying the check after it’s converted to a debit.

Account-receivable conversion is when a firm destroys a paper check after it’s converted into a debit.

Telephone-initiative debit/check-by-phone is when clients provide their bank information over the phone to convert to a debit.

Web-initiated debit is when a client initiates an electronic payment online.

Legal payments software can also help keep attorney and client funds easily separated. These types of tools help you seamlessly manage physical and electronic client payments between your firm’s trust account and operating account while ensuring compliance.

Maintain Complete Records

Set up specific accounting ledgers for all client trust balances and activity. This involves maintaining invoices, receipts, and communication related to client trust fees for each client. The ABA’s Rule 1 provides more guidance about the type of information to track. This includes (but is not limited to):

Trust account ledger for recording deposits, withdrawals, date, source of funds, purpose, description of each transaction, and payee (for withdrawals)

Ledgers for each client with funds in the trust account that include each client’s name, amount of funds, description of transactions, amounts of deposits and disbursements, sources of deposits, and names of the people or entities who received disbursements from the client’s funds

Records of all electronic transfers, including the name of the person who authorized the transfer, recipient of the funds, date, name of recipient, and confirmation of date and time from the bank or financial institution that they completed the transfer

Copies of routine trial balances and reconciliations maintained by the lawyer

Electronic or physical equivalents of bank statements, deposit records, pre-numbered canceled checks, substitute checks from the financial institution, and checkbook registers

Copies of compensation agreements and bills for expenses and legal fees with the client

Copies of accountings to third parties or clients showing disbursement of client’s funds

Copies of records for disbursements made on a client’s behalf

Copies of all other relevant client files related to transactions

Transparency helps ensure you’re accurately using funds, makes it easier to share information with clients, and contributes to maintaining a healthy cash flow for your law firm.

We highly recommend electronically managing all trust fund accounting to avoid the mistakes of hand-written records. MyCase’s legal accounting software can help you efficiently and easily monitor client and admin ledgers under a single platform.

In addition to internally maintaining accurate records, you should also request monthly trust accounting statements from your bank to ensure that all activity matches your firm’s ledgers.

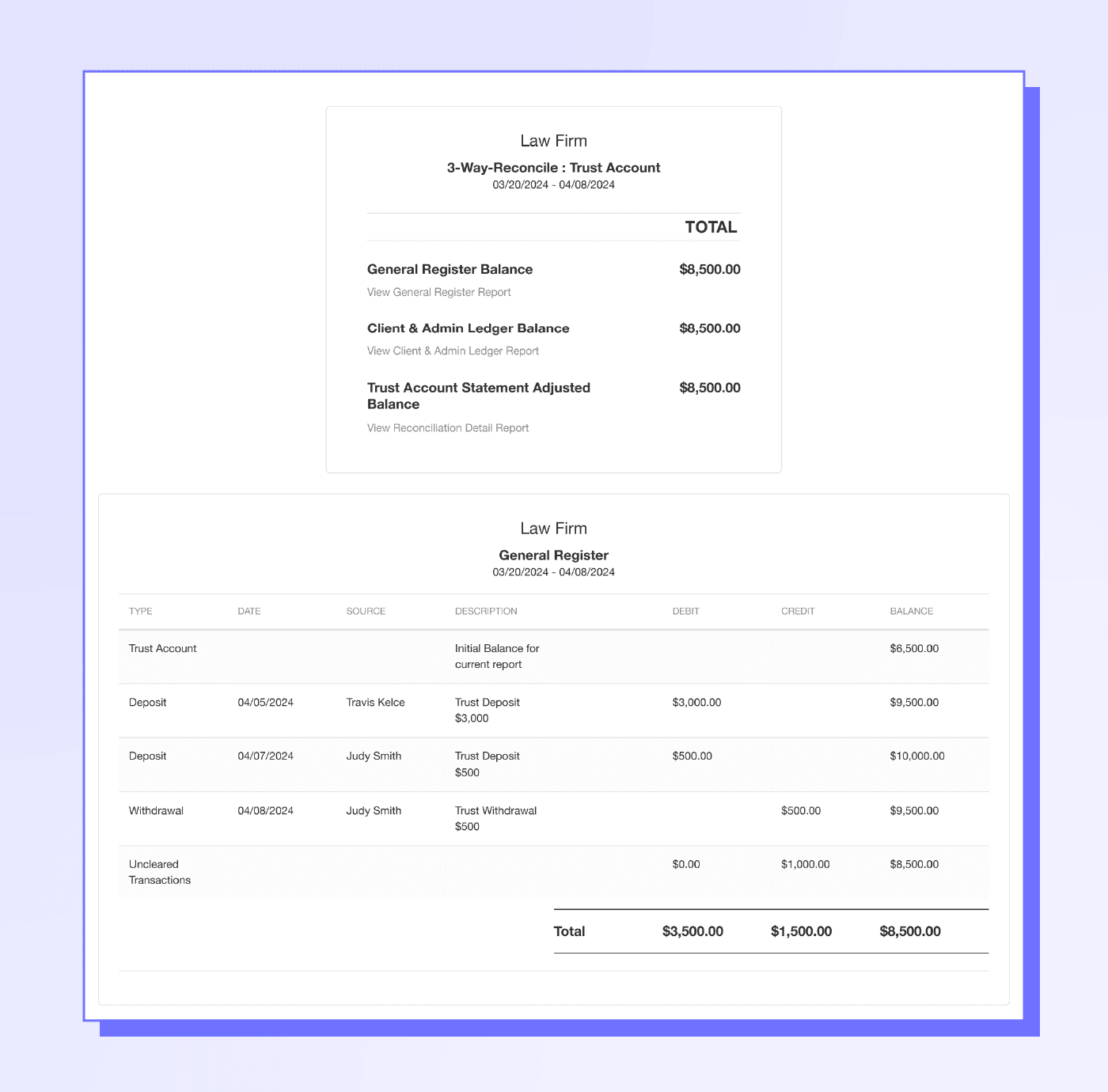

Reconcile Accounts At Least Quarterly

The ABA’s model rules recommend reconciling accounts at least quarterly and, ideally, monthly. Regular reviews help law firms maintain compliance while also ensuring accurate records.

Three-way bank reconciliation is an essential compliance step. The three ways steps are comparing:

The bank statement ending balance plus or minus any in-transit transactions

The balance in the trust bank account, which is reconciled to the bank statement

The total balance of all of the individual trust ledgers for the balance of the parent account trust ledger if you use the customer method to track individual balances in a single trust account

When using the customer method, you must know what is in the total sum of the parent account. The Bar Association wants to see that you know to the penny what is in each account that totals the entire trust bank account balance.

If you use MyCase Accounting with our sister brand, LawPay, you can leverage Automated Smart Deposits, one feature of our Automatic Bank Reconciliation process.

Automated Smart Deposits automatically creates deposit slips and matches them to the appropriate LawPay bank transactions. This helps reduce time and potential errors that come from manually matching deposit slips.

Automatic Bank Reconciliation uses information from Smart Deposits to streamline the reconciliation process. If your accounts are connected to MyCase, you’ll have all transactions accurately logged in one spot—making it easier to quickly compare and update entries each month.

Keep Records For Five Years After Termination

The ABA requires firms to keep client trust account records for five years after legal services conclude.

Maintaining records is also helpful for addressing issues from previous clients and verifying discrepancies that may come up after the case is completed.

Trust Accounting Basics

Download Guides

Tips for Creating an Efficient Trust Accounting System

Trust accounting is a meticulous process that can be challenging to do. Below are a few more tips your law firm can consider to help improve your trust accounting system.

Review state and county-specific rules to ensure you’re abiding by all requirements.

Establish guidelines and train staff on processes to enforce compliance across the firm.

Discuss billing processes with the client so they know how you’re handling their funds and how you’ll invoice their account ahead of time.

Use automated accounting software to speed up the recordkeeping process, minimize human error, and easily access and share information with your firm and its clients.

Easily Manage Trust Accounts with MyCase

Streamlining your trust accounting system is achievable once you understand the rules and have the right tools to optimize your processes.

Consider adopting MyCase Accounting to manage legal trust accounts easily and efficiently. Our cloud-based law firm accounting software houses your firm’s financial data in one platform. With our seamless platform, you can maintain visibility, compliance, and control over all law firm transactions.

We offer affordable yearly and monthly subscriptions you can cancel at any time.

Try MyCase risk-free with a 10-day free trial.

About the author

Lynda ArtesaniSME